DiffusionData Releases Diffusion 6.9

New features, performance enhancements and bug fixes

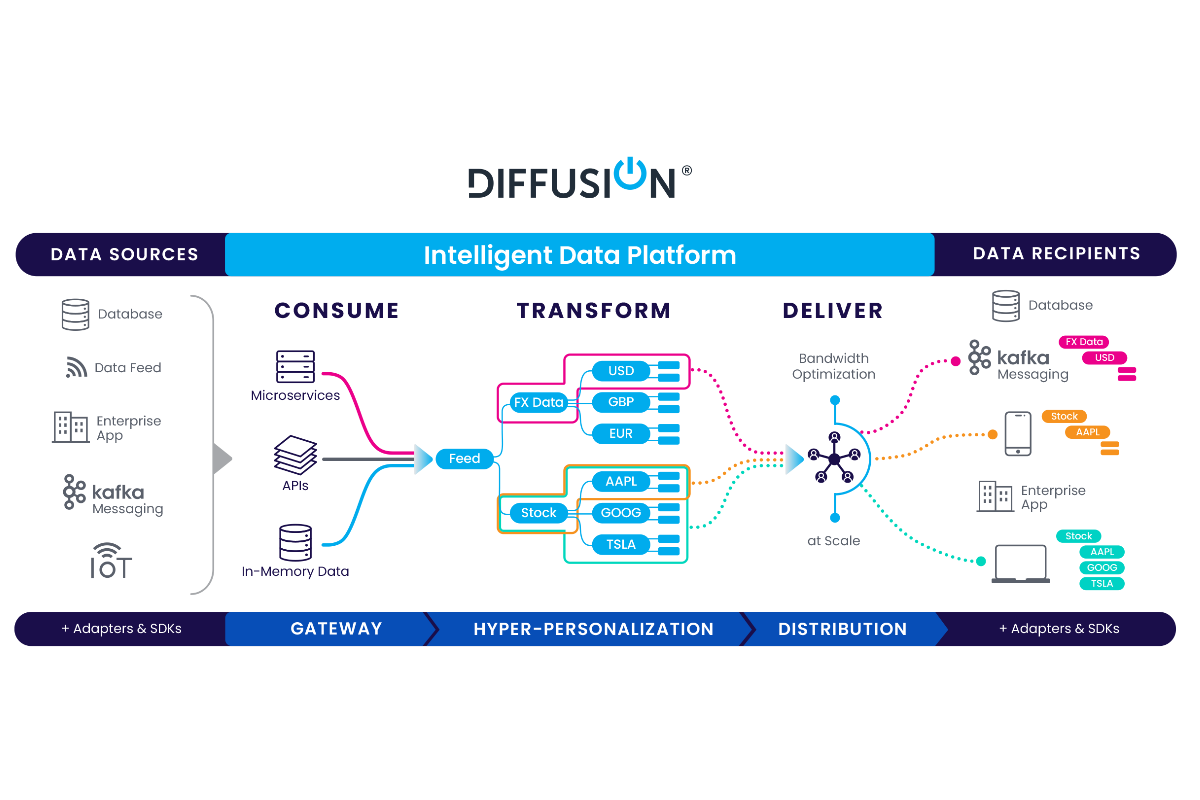

DiffusionData, formerly known as Push Technology, the pioneer and leader in real-time data streaming and messaging solutions, today announced the release of Diffusion 6.9, the Intelligent Data Platform that consumes, enriches, and delivers data among applications, systems, and devices.

Remote Server Reverse Connection

Previously, remote server connections would be initiated from the secondary server, connecting to a primary server (or cluster) with no need for any configuration at the primary server.

With this release, a new mechanism for the connection of remote servers has been introduced which may be used in situations where inbound connection to back-end (primary) servers is not allowed for reasons of security. In this mode, a primary server (or cluster) makes a ‘reverse’ connection to the secondary server (or servers) which then establishes a secure connection over the same network channel. New remote server types that are defined at both; the primary and secondary servers have been introduced.

Initial connection retry strategy

Previously, if a Diffusion client failed to connect to a server, it would have to detect a transient connection exception, and then retry the connection. This led to boilerplate code being necessary in all client applications.

With this release, client applications have the ability to define an initial connection retry strategy which allows the client connection to be automatically retried a number of times, or until it succeeds.

Metrics Improvement

Several new metrics have been added, covering; the number of topic values stored, the memory overhead relating to each remote server, and the number of bytes used for file persistence.

The bytes topic metric no longer double-counts bytes shared between a reference topic and a source topic and topic metrics can now be grouped by topic view.

Gateway Framework

The Gateway Framework, which was previously released as a beta, with a dependency on 6.8 is now to be released as a general release version 1.0.0 with a dependency upon Diffusion 6.9. The

Kafka adapter, CDC adapter, and REST adapter (using the Gateway Framework) will now also be released as separate general release products.

Other improvements

- Communication between servers in a cluster now supports TLS.

- There is a new connector ‘readiness’ condition which may be used to prevent a connector from being available until the persistence restore is complete.

- More functionalities have been added to the Python client API.

# # # #

About DiffusionData

DiffusionData, has pioneered and had led the market in real-time, data streaming and messaging solutions that dramatically reduce network bandwidth requirements, allowing customers to expand their businesses.

The company’s Diffusion® Intelligent Data Platform, consumes raw data in any size, format, or velocity; enriches the data in-flight; and distributes the data in real time — reliably and at massive scale with secure, fine-grained, role-based access control. Diffusion is purpose-built to simplify and speed data-driven, real-time application development, reduce operational costs, and economically deliver hyper-personalized data at Internet scale.

Leading brands, across industries including financial services, transportation, energy, retail, healthcare, eGaming, and Internet of Things companies, use the Diffusion Intelligent Data Platform to drive customer engagement, fuel revenue growth, and streamline business operations. Diffusion is available on-premise, in-the-cloud, or in hybrid configurations, to fit the specific business, regulatory, and infrastructure requirements of the event-driven applications operating in today’s everything connected world. Learn more at www.diffusiondata.com.