Latest News

PlayBit Casino Token: A Pioneering Venture in the Crypto Gaming World

In an era where digital innovation and with technology advancing at an astounding pace. Cryptocurrencies once perceived to be an idea have now been widely adopted and accepted for both transactional and as a form of currency. Gambling as the oldest form of entertainment is not any different, with blockchain technology available, it is evitable that Crypto-Based online casinos will emerge. The Crypto gambling industry with an estimated valuation of 250 Million USD, is just a drop compared to the gargantuan gambling industry which is worth at least 93 billion USD as of 2023.

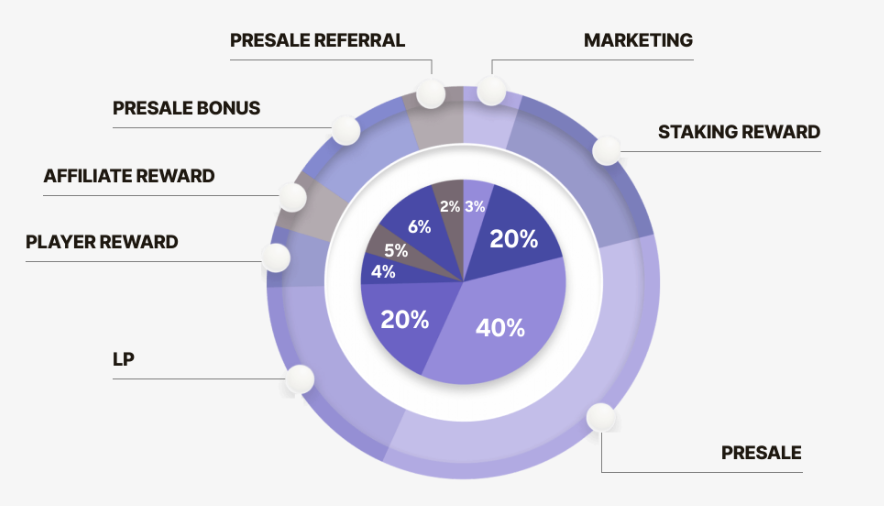

PlayBit aims to capitalize and revolutionize this industry by introducing an avant-garde tokenomics model, centered around the $PLAYBIT token, designed to optimize the gaming experience and maximize player rewards. The project’s deflationary strategy, featuring buybacks and token burns, ensures the intrinsic value of $PLAYBIT appreciates over time, directly benefiting token holders and investors and sustaining project growth.

ERC-404:

So what is ERC-404 ? It simply means it is a token standard that allows users to buy and sell fractions of NFTs, enabling broader participation in high-value assets and creating new investment opportunities.

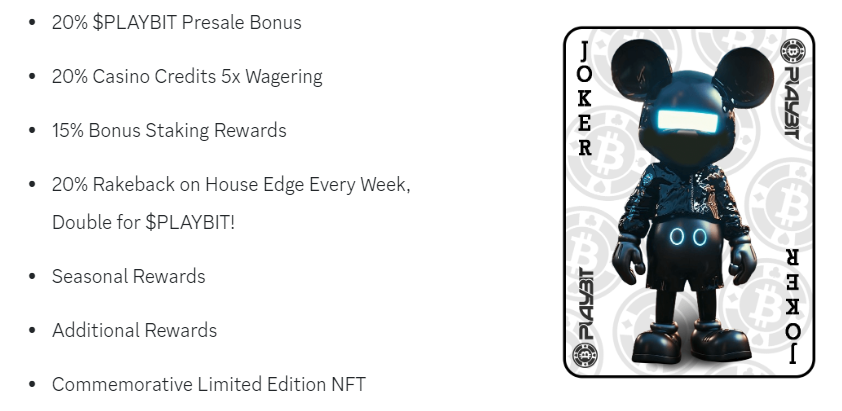

PlayBit incorporates the ERC-404 NFT as a form of ownership by purchasing $PLAYBIT tokens, users can then stake PLAYBIT tokens which offer unparalleled benefits such as enhanced rewards, including access to exclusive games, higher cashbacks and VIP rewards within PLAYBIT’s casino platform. These innovations not only enhance the gaming experience but also provide substantial financial incentives for players.

Presale:

The PLAYBIT token presale presents a unique opportunity for early adopters to be part of PlayBit’s journey from the ground up. Benefits of joining the presale include special discounts, early access to the platform’s features, and a chance to maximize investment potential ahead of the full launch.

Full details can be found at PlayBit Casino

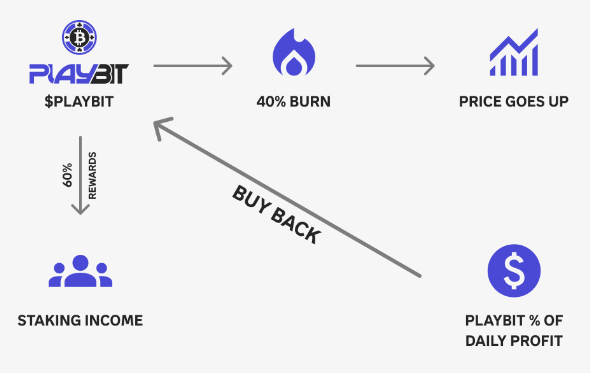

Sustainable Growth Through BuyBack and Burn

Sustainability has always been a key concern for participants, how will the platform grow its revenue, how will the tokens I own appreciate with the projects grow. Therefore, a key pillar of PlayBit’s strategy for sustainable growth and token value appreciation is its BuyBack and Burn program. By allocating a significant portion of profits to repurchase and burn tokens, PlayBit ensures a steady increase in token scarcity and value, directly benefiting its community.

Strategic Partnerships and Gaming Library

With partnerships with top-tier game providers and an extensive library of over 10,000 games including but not limited to Live Casino games, slot machines, sports betting to even our very own in-house designed RNG Games with such offerings, PlayBit is set to offer an unmatched gaming experience. This expansive selection ensures that PlayBit has something for every player. PlayBit delivers quality and diversity in gaming parallels the innovative approaches seen in the market, aiming to redefine user expectations and experiences in crypto gaming.

Regulatory Compliance

Operating under a license from the Curacao eGaming Authority, PlayBit guarantees a secure, transparent, and fair gaming environment. This commitment to regulatory compliance and operational excellence is bolstered by a team with extensive experience in both the crypto and gaming industries, ensuring PlayBit’s strategic vision is executed flawlessly with a commitment to user security and fair play.

Conclusion: A Unique Investment Opportunity

As the crypto and casino worlds converge, PlayBit represents a unique intersection of innovation, entertainment, and investment potential. The project’s strategic approach to tokenomics, community rewards, and gaming diversity positions it as a notable contender in the crypto casino space, promising a vibrant future for investors and gamers alike.

More information on PlayBit website and social media.

Latest News

Rivalry Reports Full-Year 2024 Results as Strategic Turnaround Takes Hold, Operating Loss Narrows, and Efficiency Improves

Operating expenses reduced 17%, net loss narrows, and foundational rebuild positions Rivalry for a leaner, more efficient, and financially disciplined 2025

Rivalry Corp. (the ‚ÄúCompany‚ÄĚ or ‚ÄúRivalry‚ÄĚ) (TSXV: RVLY), an internationally regulated sports betting and media company, announces its financial results for the fiscal year ended December 31, 2024.

While Rivalry’s 2024 financials reflect only the earliest signals of its company-wide restructuring, the foundational work Рmost of which began in the second half of 2024 Рis now beginning to show results in 2025. The Company narrowed its net loss, reduced operating expenses by 17%, and entered the new year leaner, more focused, and closer to breakeven.

‚ÄúWe made hard decisions last year – rebuilding the product, cutting costs, and refining our approach to players – and those changes are beginning to show signs of positive impact,‚ÄĚ said Steven Salz, Co-Founder and CEO of Rivalry. ‚ÄúThe latter half of 2024 set the stage, and we‚Äôre encouraged by the progress seen so far in 2025.‚ÄĚ

FY2024 Highlights

- Net revenue of $13.6 million, compared to $16.2 million in 2023.

- Operating expenses decreased 17% to $32.2 million, down from $38.8 million.

- Net loss of $22.4 million, compared to $23.8 million.

- Deferred revenue of $4.1 million related to pre-sales of Rivalry’s on-platform crypto token.

- Year-end cash of $2.7 million, with materially lower run-rate operating expenses entering 20251.

Organizational Rebuild & Operating Leverage

Rivalry spent the latter part of 2024 and into Q1 2025 executing a comprehensive overhaul across its cost base, product, player strategy, and operational structure. With most changes now implemented, early signs of progress are emerging. Highlights include:

- Lean operating model, with breakeven net revenue now approximately $600,000 USD/month, down from over $2 million USD/month a year ago. Further reductions to operating costs are planned in Q3 2025 to lower the breakeven point even more.

- Restructured VIP program and onboarding, improving retention and monetization from high-value players.

- Expanded casino product, improving baseline stability through missions, races, and progression-based systems.

- Platform upgrades enhancing site speed, responsiveness, and conversion.

- Crypto-native infrastructure overhaul, including a rebuilt cashier, improved user experience (‚ÄúUX‚ÄĚ), and token-ready architecture to support long-term on-chain growth.

These efforts have driven early improvements across the Company’s core key performance indicators in 2025:

- Net revenue per active user and wagers per user at record levels (excluding customary outliers).

- Deposit growth in nearly every month from November 2024 through June 2025, despite minimal marketing spend.

- Monthly new first-time depositors (FTDs) up approximately 40% since January 2025 on flat monthly spend. Average payback on cohorts acquired during this period was approximately 1.5 months, highlighting improved customer acquisition efficiency.

2025 Momentum and Execution

In the first half of 2025, Rivalry continued executing against its strategic turnaround, with a focus on increasing player value, tightening operational efficiency, and accelerating near-term revenue drivers. Key initiatives included:

- Loyalty Program v2: Building on the success of the end-2024 launch, the next iteration of Rivalry’s on-site loyalty program is in development, designed to deepen progression, improve engagement, and anchor major campaigns throughout Q3 2025.

- New Promo Engine: Launching this summer, the rebuilt system introduces immediate-match deposit offers and new promo types, integrated directly into onboarding and reactivation flows to lift first time deposits and retention.

- Customer Relationship Management (‚ÄúCRM‚ÄĚ) and Always-On Optimization: Active performance reviews of core flows, geo-targeted reactivation campaigns, and structural upgrades to improve output across the customer lifecycle.

- VIP & High-Value-Player Activity: Fully structured outreach live across geos, with segmentation, high-touch CRM, and LTV-based targeting to reactivate high-value-players.

- Cashier & Site Speed: Continued improvements to platform speed, including faster load times, and reduced friction in cashier UX.

- Ongoing UX Improvements: Consistent updates across the site aimed at visual polish, design coherence, and front-end responsiveness to deliver a cleaner, more reliable user experience.

These initiatives have laid a foundation entering the second half of 2025. The focus now is on maintaining momentum, tightening execution, and scaling revenue through improved player economics and operational leverage.

Strategic Review

The Company’s previously announced evaluation of strategic alternatives remains ongoing. Rivalry continues to explore a range of potential outcomes aimed at maximizing shareholder value. There is no assurance regarding the timing or results of this review.

Outlook

While the 2024 annual results capture only the early innings of Rivalry’s strategic transformation, the changes made throughout the year have meaningfully repositioned the Company. With a leaner cost structure, stronger product, and increasing revenue efficiency, Rivalry is entering the second half of 2025 with sharper operational discipline and renewed focus.

Additional updates will be provided alongside the release of the Company’s financial results for the three months ended March 31, 2025, which are expected to be released on or prior to July 14, 2025.

Unsecured Loan

The Company also announces that it has secured a US$475,000 principal amount senior unsecured loan from its existing senior lender, maturing on September 30, 2025, with an interest rate of 10% per annum (the ‚ÄúLoan‚ÄĚ). The Loan reinforces the Company‚Äôs senior lender‚Äôs support for the Company‚Äôs ongoing strategic review process and provides the Company with additional flexibility to continue pursuing its strategic initiatives to maximize long-term stakeholder value.

Update Regarding Management Cease Trade Order

The Company is providing this update on the status of a management cease trade order granted on May 1, 2025 (the “MCTO“) by its principal regulator, the Ontario Securities Commission (the “OSC“), under National Policy 12-203 ‚Äď Management Cease Trade Orders (“NP 12-203“). On May 2, 2025, the Company announced that there would be a delay in the filing of its annual financial statements, management‚Äôs discussion and analysis and related CEO and CFO certificates for the fiscal year ended December 31, 2024 (collectively, the “Annual Filings”), as required under applicable Canadian securities laws (the “Default Announcement“). On June 18, 2025 the Company further announced that it expects to file its unaudited financial statements and management‚Äôs discussion and analysis for the three months ended March 31, 2025 and related certifications (collectively, the “Q1 Filings“) on or prior to July 14, 2025. Although the Annual Filings have now been filed, the OSC has advised the Company that the MCTO will remain in place until the Q1 Filings have been completed.

The Company advises that: (i) there have been no material changes to the information contained in the Default Announcement; (ii) it intends to continue to comply with the alternative information guidelines of NP 12-203; and (iii) except as previously disclosed, there are no subsequent specified defaults (actual or anticipated) within the meaning of NP 12-203.

The MCTO will remain in effect until the Company is no longer in default with respect to its filing requirements and the OSC lifts the cease trade order.

Latest News

Zenith partners with Paraguay’s Jugamax to expand ONEAPI Game Aggregation across LatAm

New partnership to see Asia’s leading aggregator expand with operator across Paraguay, Chile and Mexico

Zenith, Asia’s premier iGaming platform provider, has today announced a new partnership with Jugamax, one of Paraguay’s leading operator brands.

Through this new partnership, Zenith will deliver an expanded gaming experience to Jugamax’s players across LatAm via ONEAPI, its award-winning game aggregation platform.

Zenith’s latest deal is expected to be the first of many in LatAm with 2025, with Asia’s leading aggregator already delivering its services to 500 global operators and over 50 million players.

This collaboration will provide Jugamax with seamless access to more than 10,000 top-quality game titles from 150 studios across the operator’s key markets including Chile, Mexico and Paraguay.

Through Zenith’s single, easy-to-integrate solution, Jugamax can now tap into a world-class library of slots, live casino and instant games, each designed to drive both engagement and retention Рempowering Jugamax to scale rapidly as it continues its expansion across LatAm.

Jugamax’s integration with ONEAPI will also enable the operator to benefit from faster onboarding, dedicated technical support and access to exclusive rates for leading studios.

This partnership reÔ¨āects Zenith‚Äôs ongoing commitment to providing operators with scalable, efficient and high-performing solutions tailored to the unique intricacies of markets across the LatAm region.

Commenting on the new partnership, Karina Moral, Senior Business Development Manager at Zenith, said: “Partnering with Jugamax marks an exciting step in Zenith‚Äôs expansion across LatAm. Their local expertise combined with our powerful aggregation platform will create new opportunities for growth, innovation, and player engagement in Paraguay, Chile and M√©xico.

‚ÄúWe already have a global reputation as an award-winning Asia aggregator and we have big plans to expand across LatAm in 2025 and beyond, with a tailored suite of product designed for the exact needs of local players.‚ÄĚb

Compliance Updates

MGM Yonkers Submits Commercial Casino License Application in New York

MGM Yonkers Inc., a subsidiary of MGM Resorts International, submitted its commercial casino license application to the New York Gaming Commission and the Gaming Facility Location Board, with a $2.3 billion proposal to transform its historic Empire City Casino site into a commercial casino and entertainment destination. The development plans have been thoughtfully curated to achieve the maximum benefits for the State of New York, City of Yonkers and surrounding counties, while also meeting the needs of the local community.

MGM Yonkers’ plans include the full renovation and expansion of Empire City Casino’s existing gaming areas, an expansive high-limit lounge and the addition of a state-of-the-art BetMGM Sportsbook offering retail sports betting. The plan also envisions the addition of a 5000 person maximum capacity entertainment venue and accompanying meeting space which will welcome a variety of A-list and local performances with the design flexibility to accommodate special events, local graduations, and other community needs.

Additionally, three new full-service restaurants and the renovation of existing food and beverage venues will provide high-concept dining options for guests. A parking garage with solar energy arrays and electric vehicle parking spaces are among features that demonstrate MGM Resorts’ strong commitment to sustainability. If MGM Yonkers is awarded a commercial casino license, it anticipates completing all project elements by mid-2029.

‚ÄúEmpire City Casino and Yonkers Raceway have anchored the entertainment and tourism culture in downstate New York for more than a century. Achieving a full casino license will ensure this site will continue to be a cultural and economic force for generations to come,‚ÄĚ said Bill Hornbuckle, President and CEO of MGM Resorts International.

-

eSports7 days ago

eSports7 days agoBETBY EXPANDS LATAM FOOTPRINT WITH MOBADOO ESPORTS PARTNERSHIP

-

Latest News6 days ago

Latest News6 days agoOptimove and EveryMatrix Launch Real-Time Integration to Power Smarter Marketing for iGaming Operators

-

Latest News6 days ago

Latest News6 days agoBetano, Official Sponsor of CONMEBOL Copa Am√©rica Femenina 2025‚ĄĘ

-

Latest News6 days ago

Latest News6 days agoSpotlight 29 Casino and Tortoise Rock Casino to Launch Konami Gaming’s SYNKROS Casino Management System

-

Compliance Updates6 days ago

Compliance Updates6 days agoNew Bill in California Could End Online Sweepstakes Gaming

-

Central America6 days ago

Central America6 days ago21VIRAL Boosts Latin American Reach Through Strategic Partnership with Virtualsoft

-

eSports6 days ago

eSports6 days agoEsportes da Sorte celebrates Brazilian culture with Parintins and S√£o Jo√£o Sponsorships

-

Compliance Updates6 days ago

Compliance Updates6 days agoNew Initiative from DI Council Aims to Enable Betting on Professional Sports