eSports

Most Popular Esports Raging in the Market in 2023

The Esports industry is always buzzin’. There are way too many options and a suitable choice for literally everyone!

Best Esports Games Of 2023

Your parents are either a) out of touch or b) oblivious to the future if they have ever described your love of video games as a major time waster. Even though it may sound overly harsh, this point of view has some validity. Esports, the competitive gaming segment of the video game industry, has amassed sizable audiences, massive prize pools, and sponsorships, enabling top players to transform their pastimes into lucrative careers. Games from many different genres, both well-known and obscure, are included in Esports—the scene in the Esports sector for all players.

Are shooters your thing? Using Counter-Strike Global: An offensive opponent can be destroyed with a few caps. Do you want to participate in a Titanic battle royale? PlayerUnknown’s Battlegrounds has you covered. Fan of sports? The NBA and Take-Two Interactive, the publisher of the immensely popular NBA 2K video game franchise, partnered to introduce the NBA 2K eLeague as a synthesis of the two worlds. The Esports industry has a video game and related scene for everyone. If you want to start betting on Esports, check out https://gg.bet/en/fortnite

There could be an excess of choices. The abundance of multiplayer, competitive video games on the market makes it intimidating to begin playing or watching competitive video gaming. Fortunately, this ranking of the best Esports games can guide you. Every game competing for that mouthwatering Esports cash is not worth your time. Additionally, there are several of those.

The Most Popular Esports of 2023

1. Apex Legends

After creating two excellent but underrated Titanfall games with the aid of the hugely successful battle royale shooter Apex Legends, developer Respawn finally received the credit it always deserved.

Instead of controlling hefty robots in Apex Legends, which is set in the Titanfall universe, you can control quick infantry. Fortunately, these lively people have a wide range of specialized knowledge. For instance, Mirage and Wraith can travel between realities and create holograms.

Effective communication techniques also keep the team together. Apex Legends has continued to gain great popularity because of its ongoing tournaments. Look at the schedule for the incredibly huge prize pools for upcoming tournaments.

2. Counter-Strike: Global Offensive

Valve’s 2012 release of Counter-Strike: Global Offensive (CS: GO) was built upon a long tradition of multiplayer first-person shooter games, such as the original Counter-Strike and Counter-Strike: Source. Years later, the action-packed PC game mostly compares positively with more modern titles, thanks partly to its solid core gameplay and active community. However, Overwatch’s theme depth and CS: GO’s declining aesthetics are also shortcomings. Nevertheless, many people enjoy CS: GO’s simple gameplay and very competitive Esports culture, including the Eleague Major, a $1 million prize competition.

3. Dota 2

The saying goes, “Easy to learn, hard to master.” This phrase is used to denote various things, especially in gaming. One of the few games that best illustrates the adage is Defence of the Ancients 2 (Dota 2), one of the world’s most popular multiplayer online battle arena (MOBA) games. In this free-to-play MOBA, you must select one of the more than 100 playable Heroes and engage in a battle using that character’s unique abilities, attributes, and playstyle to help your team win.

4. Call of Duty: Warzone 2.0

In the increasingly crowded battle royale market, Call of Duty still had much to offer shooter aficionados, as the original Warzone showed. Alongside the release of Modern Warfare II was a full-fledged sequel called Warzone 2.0. Building 21 and DMZ, two new game modes, are available as a result. As with the first Warzone, a popular series won’t immediately lose so many players. For expert players who wish to compete in major competitions, version 2 is currently the hottest.

Final Thoughts

Recent years have seen an increase in the popularity of esports video games, which are intensely competitive computer games dominated by titles like Valorant and Counter-Strike: Global Offensive. Players compete against one another in rounds in a variety of genres, such as first-person shooters and arcade beat ’em ups, to see who is the greatest.

eSports

Esportes da Sorte celebrates Brazilian culture with Parintins and São João Sponsorships

Esportes Gaming Brasil, the owner of Onabet and Esportes da Sorte, is making its debut at the 58th Parintins Folklore Festival with an interactive project that blends cultural promotion, economic development, and social responsibility.

The brand becomes the first regulated betting operator to offer institutional support to the event, which welcomes around 120,000 visitors and generates BRL 184 million in local economic activity, according to the Amazonas State Government.

This cultural commitment comes on the back of Esportes Gaming Brasil sponsoring 31 São João festivals during June in 27 cities across the Northeast and Southeast regions. This initiative strengthens the brand’s strategy of connecting with the public through the appreciation of Brazilian cultural expressions.

Esportes da Sorte’s focus was creating memorable experiences as each event featured scenography by Pernambucan artist Perron Ramos. Another notable element was the Vila Junina (June Village), a themed area blending traditional elements with interactive experiences. Classic games such as Pescaria da Sorte (Fishing of Fortune), Barraca do Beijo (Kissing Booth), and Argola da Sorte (Ring Toss) bring nostalgia to the festivities.

For the three-day Parintins Folklore Festival starting today, the brand will be energising Parintins with a series of experiences celebrating local culture. These include a panoramic lounge with a special view of the Bumbódromo, the Truck da Sorte — a space combining karaoke and free hydration — as well as a Social Arena installed in the Garantido and Caprichoso neighborhoods, featuring artistic performances, rest areas, free water distribution, and Instagram-worthy spots. Festivalgoers will also be able to get their hands on custom giveaways throughout the festival. All elements of the visual project are inspired by Amazonian art. The graphics feature illustrations by Curumiz, a Parintins-based duo formed by Alziney Pereira and Kemerson Freitas.

Sofia Aldin, CMO of Esportes Gaming Brasil, the group behind the brand commented: “Esportes Gaming Brasil cares passionately about regional values and strengthening Brazilian popular culture. It’s more than simply showcasing our brand, we want to create value for the people who live for events like the Parintins Folklore Festival and the São João festivals. Being part of these events backs our strategy of supporting traditions that drive local economies and celebrate regional identities.”

eSports

BETBY EXPANDS LATAM FOOTPRINT WITH MOBADOO ESPORTS PARTNERSHIP

BETBY, a leading sportsbook supplier, has announced a new partnership with prominent LATAM-focused esports provider Mobadoo, in a move that will see its Betby.Games portfolio fully integrated into Mobadoo’s product lineup.

This collaboration enables Mobadoo — which has an established presence and deep market understanding across Latin America — to incorporate BETBY’s proprietary and award-winning esports offering, delivering dynamic and fast-paced betting content to its growing user base. Among Betby.Games’ titles are eSoccer, eBasketball, eFighting, eCricket, eShooter, eHorse Racing, eTennis, and the Brazil-relevant eVaquejada.

As one of the most comprehensive and high-frequency esports betting solutions in the industry, Betby.Games offers access to more than 70 tournaments, over 350 betting markets, and more than 300,000 live matches each month. This collaboration will not only enhance Mobadoo’s offering but also reinforce BETBY’s position as a leading esports supplier in the LATAM region, a key pillar in the supplier’s global expansion strategy.

“Mobadoo has an excellent reputation and strong regional expertise, making them an ideal partner for us. Their commitment to innovation in esports and the rapid growth of this vertical in the region made our partnership only a matter of time,” commented Kirill Nekrasov, BETBY’s Head of Sportsbook Product. “This agreement not only expands the reach of our unique Betby.Games content, but also aligns perfectly with our global strategy of delivering flexible, high-performance esports solutions to next-generation operators. Together, we’re set to further strengthen our leading position in the LATAM region.”

José Aníbal Aguirre, Chief Marketing Officer at Mobadoo, added: “We’re thrilled to integrate Betby.Games into our offering. The depth and quality of their esports content is unmatched, and this partnership gives us a powerful new edge in catering to LATAM’s passionate esports fanbase. With BETBY’s support, we’re confident we can elevate the player experience and unlock new growth opportunities across the region.”

eSports

Red Bull Home Ground Heads to New York this November

Red Bull Home Ground, the pro VALORANT invitational, is set to make its return with a blockbuster fifth edition, bringing together the world’s top teams to New York City, for one of the most exciting showcases in the esports calendar. From November 13–16, the iconic Hammerstein Ballroom at the Manhattan Center will host four electrifying days of competition, as global giants and rising stars fight to claim the title of 2025 off-season champions.

This year, Red Bull Home Ground will feature a stacked lineup of elite contenders. Returning champions T1 are ready to defend their crown, joined by two-time VCT Global Event winners Fnatic and fan-favourites G2 Esports, Sentinels, and ZETA DIVISION. Joining these giants will be the two top teams who earn their place through the Play-In Stage and an additional team to be revealed – a gauntlet of global qualifiers open to all in India, USA, Spain, Turkey, Chile, Egypt, Belgium, Germany, South Africa, Netherlands, Japan, and EMEA qualifiers, giving players around the world the chance to earn a spot to go against the best-of-the-best on the main stage. The final main stage slot will be revealed at a later date.

For the first time, the Red Bull Home Ground World Final will be hosted in the United States, taking place at the legendary Hammerstein Ballroom in Manhattan. Known for its grand Beaux-Arts architecture and storied history hosting icons like The Grateful Dead and Guns N’ Roses, the venue offers a perfect blend of classic New York legacy and modern spectacle for this high-stakes tournament. The action kicks off on November 13-14, with both days dedicated exclusively to the Play-in stage and the opening stages of the competition. For fans eager to experience the action live, tickets for the public main stage event on November 15-16 are available for purchase via Ticketmaster.

At last year’s Red Bull Home Ground in Berlin, fans were treated to an unforgettable grand final as T1 stormed to victory over Cloud9, clinching the championship title with a dominant 3-1 series. With every edition, Red Bull Home Ground has elevated the VALORANT off-season calendar, known for its fast-paced format, jaw-dropping plays, and international flair. Red Bull Home Ground continues to be a staple tournament for pro teams looking to compete against the best competition and for fans ready to witness thrilling match-ups.

-

Canada7 days ago

Canada7 days agoAGCO Fines Great Canadian Casino Resort Toronto $350,000 for Serious Regulatory Violations Linked to Impromptu After-Party on Gaming Floor

-

Compliance Updates7 days ago

Compliance Updates7 days agoEsportes da Sorte holds forum on “Integrity in Sports” with Ceará and Náutico

-

Latest News7 days ago

Latest News7 days agoBlokotech unveils Cristian Tonanti as new Casino Partnership Manager

-

Latest News7 days ago

Latest News7 days agoEDGE Boost Named Preferred Payment Method for World Series of Poker Event Series

-

Latest News7 days ago

Latest News7 days agoFIRST and Genius Sports Extend Landmark Data Partnership, Powering Continued Growth

-

Canada7 days ago

Canada7 days agoIGT and Atlantic Lottery Sign Eight-Year Video Lottery Central System Technology Agreement

-

Latest News6 days ago

Latest News6 days agoNASCAR & iRacing Renew Partnership with PlayVS

-

Latest News4 days ago

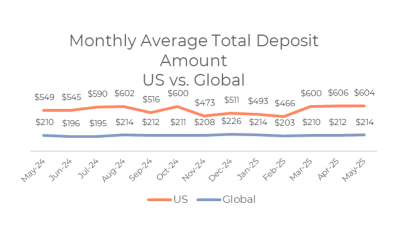

Latest News4 days agoRivalry Reports Full-Year 2024 Results as Strategic Turnaround Takes Hold, Operating Loss Narrows, and Efficiency Improves