Latest News

Super Group to go Public in Merger with an Acquisition Firm

Betway’s parent company Super Group is nearing a deal to go public through a merger with blank-check acquisition firm Sports Entertainment Acquisition Corp at a valuation of about $5.1 billion.

The deal comes as Betway, which has its roots in Europe, expands in the US. Betway has also agreed to acquire Digital Gaming Corp, tapping the online sports betting and gaming market in 10 U.S. states.

Shareholders accounting for more than two-thirds of Super Group’s equity will maintain their stakes under the deal.

Sports Entertainment’s executive chairman, Eric Grubman, a former National Football League (NFL) executive, will become chairman of Super Group, and Sports Entertainment CEO John Collins, a former National Hockey League chief operating officer, will join Super Group’s board.

SPACs, such as Sports Entertainment, are shell companies that raise funds in an initial public offering with the aim of merging with a private company, which becomes public as result, providing an alternative to traditional IPOs.

Latest News

Bragg Gaming Expands U.S. Content Footprint with Fanatics Casino Tri-State Launch

Bragg Gaming Group has announced the launch of its newest games and Remote Gaming Server (RGS) technology with Fanatics Casino across New Jersey, Michigan and Pennsylvania.

Fanatics Casino is America’s fastest growing online casino and is available in Michigan, New Jersey, Pennsylvania, and West Virginia on iOS, Android, and desktop. Players are invited to dive into a world of thrills as Fanatics Casino brings the casino floor directly to a customer’s fingertips, whether on-the-go or in front of a computer. Players can explore a wide array of classic and modern casino games, including slots, blackjack, roulette, progressive jackpots and video poker. Each game is crafted to deliver authentic casino action, ensuring endless entertainment.

Players in these states will benefit from access to Bragg’s full catalog, including titles from Bragg’s in-house proprietary content development studios, a roster which includes Atomic Slot Lab and Indigo Magic and Wild Streak Gaming, all through Bragg Gaming’s Remote Games Server (RGS) technology, delivered via the Bragg HUB platform.

In addition, titles from Bragg’s multiple studio partners, including Incredible Technologies, Bluberi, King Show Games, and Sega Sammy Creation will also be available to players in all three regulated markets along with top-performing titles like “Cai Fu Emperor Ways” and “Queenie” and a host of other elevated content from Bragg’s Atomic Slot Lab studio.

This roster of studio partners, which is constantly being updated, now also includes Boomerang Studios, Four Leaf Gaming and Reflex Gaming, who will all launch titles on the Bragg RGS later this year.

This expansion is the latest step in Bragg’s drive to deliver engaging and game-changing content to players across the North American market.

The launch supports Bragg Gaming’s strategic goals by accelerating the growth of utilization of Bragg’s exclusive and proprietary content, and the diversification of revenue through expansion into North American markets.

Matevz Mazij, CEO Bragg Gaming Group commented: “With its history of connecting sports fans with merchandise they love and with sports betting and the strong cross sell between sports betting and iGaming, this launch represents a great opportunity to showcase Bragg’s amazing titles across the three biggest iGaming markets in the US.”

“We look forward to developing our relationship as a key partner of Fanatics Betting and Gaming in the North American market as we continue the roll-out with regular new game releases planned.”

Kieron Shaw, Manager of Fanatics Casino Games Content, said: “We’re thrilled to partner with Bragg Gaming Group to bring their diverse and engaging iGaming content to our players in New Jersey, Michigan, and Pennsylvania.”

“This collaboration is a significant step in our strategy to expand our iGaming offerings and capitalize on the substantial growth projected for these key markets. Bragg’s impressive catalogue, including titles from Wild Streak Gaming and their third-party studio partners, along with their innovative promotional tools, will undoubtedly enhance the gaming experience for our users and help us springboard our presence across these important states.”

Gambling in the USA

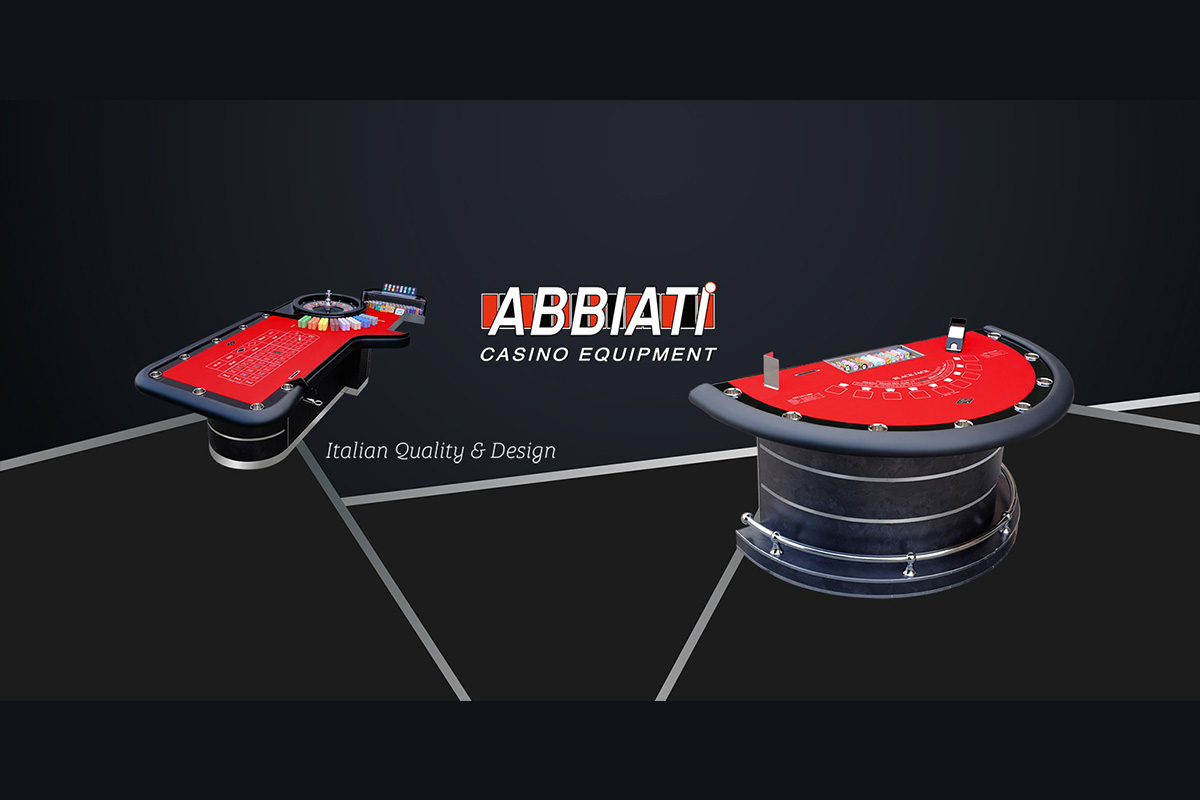

Abbiati Casino Equipment and Hawkins Holdings Form Strategic Alliance to Expand Presence Across the Americas

Abbiati Casino Equipment, a globally recognised leader in premium casino equipment and technologies, announced a strategic partnership with Hawkins Holdings to strengthen its presence across North and South America. As part of this initiative, seasoned gaming executive Roger Hawkins has been appointed Brand Ambassador and Strategic Consultant for the Americas.

With more than 20 years of executive leadership in the global casino and gaming industry, Hawkins will spearhead the company’s efforts to expand its footprint throughout the Western Hemisphere. His role will include market development, strategic partnerships, regulatory positioning, and the promotion of Abbiati’s legacy of Italian innovation, craftsmanship, and integrity.

“This partnership is about more than market entry – it’s about building deeper awareness, driving product adoption, and reinforcing Abbiati’s commitment to quality across every pit and poker room in the hemisphere,” said Hawkins.

Giorgio Abbiati, CEO of Abbiati Casino Equipment, said: “We have proudly served clients in the Americas for many years, but the time is right to deepen our focus. Roger’s knowledge of our products and his insight into the market make him the ideal partner to lead this next phase.”

Latest News

Evolution Enters Rhode Island Through Extended Partnership with Bally’s Corporation

Evolution announced a new partnership agreement with Bally’s Corporation. The agreement strengthens Bally Casino’s offering in Rhode Island, with a wide-ranging portfolio of Evolution’s slot titles, and establishes Evolution’s footprint in Rhode Island, a key milestone in its US growth strategy.

In a historic first, Evolution is now live in Rhode Island with its online slot games from its renowned slot brands NetEnt, Red Tiger and Big Time Gaming. This milestone marks Evolution’s entry into the state and establishes a presence in all seven US states which currently offer online casino gaming.

Also, under the terms of the agreement, Evolution has also introduced exclusive Bally’s branded live dealer Blackjack tables in New Jersey and Pennsylvania. These dedicated tables offer a seamless user interface integration with the Bally Bet Casino app, and will provide a premium, personalised player experience which showcases the distinctive Bally brand. In addition to these live dealer games, Bally players in New Jersey and Pennsylvania will enjoy an expanded collection of the newest and most exciting cutting-edge slot titles.

Jacob Claesson, Chief Executive Officer Evolution North America, commented: “This agreement represents a significant step forward for both Evolution and Bally’s Corporation. We’re thrilled to deepen our collaboration with Bally’s by delivering world-class gaming experiences and extend our reach into Rhode Island, a first for Evolution. This partnership showcases our shared commitment to driving innovation and providing exceptional entertainment for players.”

-

Canada5 days ago

Canada5 days agoAGCO Fines Great Canadian Casino Resort Toronto $350,000 for Serious Regulatory Violations Linked to Impromptu After-Party on Gaming Floor

-

Compliance Updates5 days ago

Compliance Updates5 days agoEsportes da Sorte holds forum on “Integrity in Sports” with Ceará and Náutico

-

Latest News5 days ago

Latest News5 days agoBlokotech unveils Cristian Tonanti as new Casino Partnership Manager

-

Latest News5 days ago

Latest News5 days agoEDGE Boost Named Preferred Payment Method for World Series of Poker Event Series

-

Latest News5 days ago

Latest News5 days agoFIRST and Genius Sports Extend Landmark Data Partnership, Powering Continued Growth

-

Canada5 days ago

Canada5 days agoIGT and Atlantic Lottery Sign Eight-Year Video Lottery Central System Technology Agreement

-

Latest News4 days ago

Latest News4 days agoNASCAR & iRacing Renew Partnership with PlayVS

-

Latest News3 days ago

Latest News3 days agoRivalry Reports Full-Year 2024 Results as Strategic Turnaround Takes Hold, Operating Loss Narrows, and Efficiency Improves