What You Need to Know About Gambling and Your 2021 Taxes

The deadline for filing 2021 federal tax returns looms on April 18 this year and for gamblers, it’s an occasion to be reminded of how the tax code addresses their gaming activity. Generally speaking, that’s not too kindly.

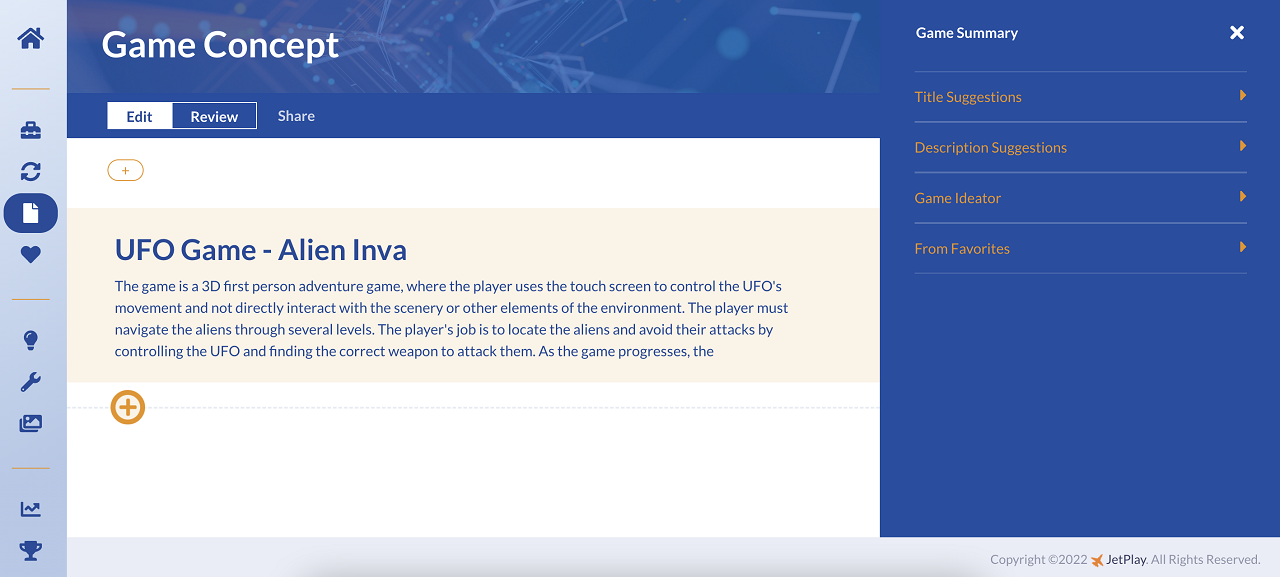

The bottom line is simple and stern. As a rule, all income from gambling — including real money online casino play — must be reported eventually on Line 8 of the familiar Form 1040 (along with inclusion on Schedule 1).

To some, it may come as a surprise that gambling income is reported as a gross figure and not a net result. That stands in contrast to, say, capital gains or losses realized in stock transactions, which are reported on Line 7 of the Form 1040 (usually, along with a Schedule D).

In plain English and by example what that means is this: If a taxpayer wins $500 playing the slots in a casino on Monday and then loses $800 playing the slots on Tuesday, the taxpayer is required to report the $500 win on his Form 1040 on Line 8. The $800 loss would be accounted for on Schedule A (Itemized Deductions) — but there are caveats.

The first may be familiar to taxpayers who gamble. Reported gambling losses cannot exceed gambling wins so in the above example, the taxpayer would have an allowable deduction of just $500 for net zero result (the gamble eats the excess $300 loss). But then there’s another issue.

The taxpayer gets to account for gambling losses only if he/she itemizes deductions on Schedule A. And as a result of the 2017 tax revision, the allowance for the standard deduction was raised to a point where it doesn’t make financial sense for the vast majority of taxpayers to itemize their deductions.

What that means for many taxpayers who gamble relatively modestly is that they have no opportunity to deduct any gambling losses. So, the gaming “win” stands alone as income even if the aggregate gambling activity was a net loss.

As an aside, the standard deduction for married couples filing a joint return for tax year 2021 is $25,100. For single taxpayers and married individuals filing separately, the standard deduction is $12,550. For heads of households, the standard deduction is $18,800.

The impacts of gross gambling income on line 8 may be subtle but can be significant. For instance, that amount gets carried down to Line 11, adjusted gross income, which can affect a range of tax circumstances, such as how much of the taxpayer’s Social Security benefits are taxable.

FUNDAMENTAL TAX RULES FOR GAMBLERS

- Taxpayers who gamble should remember that all gambling winnings must be reported as income regardless of whether the operator issues documentation, such as a W-2G or a Form 1099.

- Unfortunately, gamblers cannot “net” their winnings and losses when reporting gambling income. Gambling income is usually reported on Schedule 1 and then carried over to Form 1040, Line 8.

- Gambling losses are accounted for on Schedule A, Itemized Deductions, and taxpayers must itemize to get the benefit of a gambling loss deduction. However, taxpayers have to choose between itemizing deductions or taking the standard deduction.

- If gambling losses are taken as a deduction, they cannot exceed the amount of gambling wins.

- Win or lose, taxpayers should keep a journal of their gambling activity. They should note where, when, what games were played, and how much was won or lost. Taxpayers should also keep any evidence of wagering activity, losses included.

- State taxes may also be due on gambling winnings and rules vary from state to state. Gamblers should familiarize themselves with their state’s tax policies on gambling income.

OTHER THINGS TO KEEP IN MIND

The proliferation of gambling, both bricks-and-mortar and on the internet, has created complications for taxpayers that should be addressed by a tax professional but there are some things taxpayers should keep in mind.

As mentioned earlier, keeping a journal of gambling activity be part of your record-keeping.

Remember, all gambling winnings are reportable even if a gambling operator doesn’t issue paperwork, often a W-2G or a 1099-MISC or a 1099-K.

And speaking of W-2Gs, here are the occasions when the Internal Revenue Service says a W-2G should be issued by the gambling operator:

- 1. The winnings (not reduced by the wager) are $1,200 or more from a bingo game or slot machine;

- 2. The winnings (reduced by the wager) are $1,500 or more from a Keno game;

- 3. The winnings (reduced by the wager or buy-in) are more than $5,000 from a poker tournament;

- 4. The winnings (except winnings from bingo, slot machines, keno, and poker tournaments) reduced, at the option of the payer, by the wager are:

- a. $600 or more, and

- b. at least 300 times the amount of the wager; or

- 5. The winnings are subject to federal income tax withholding (either regular gambling withholding or backup withholding).

What may irritate taxpayers who gamble is how gambling activity is treated as opposed to something like day-trading stocks. In the latter case, which also involves substantial risk-taking, the stock day-trader gets to net losses against gains without having to choose between itemizing deductions and taking the standard deduction.

UNFAIRNESS TO GAMBLERS

The unfairness to taxpayers who gamble, particularly those who play at modest levels, was noted by the American Gaming Association, the trade group that represents the gambling industry, when the 2017 tax code was being revised.

“Under such a higher standard deduction, small and mid-level slot machine players may not be able to itemize their deductions, even with their gaming losses, and hence may not be able to offset gaming wins reported as income with the full amount of their gaming losses,” the AGA said in a letter to Capitol Hill.

“AGA strongly recommends, as a matter of tax simplification, that gaming players should be permitted to subtract gaming losses from gaming winnings in order to compute their taxable net gaming income for purposes of reporting adjusted gross income, without being required to itemize their deductions.”

Unfortunately for gamblers, that recommendation was not taken by the Congress.

For years, the AGA has been trying to get the threshold for issuing W-2Gs raised from $1,200 to $5,000 without any luck. However, early in March, the Congressional Gaming Caucus advanced an effort to raise the slot tax threshold to $5,000 with bipartisan legislation and also provide a mechanism for future increases based on inflation. The current $1,200 slot tax threshold has not been adjusted for inflation since 1977 and, since then, the instances of $1,200 W-2Gs has skyrocketed.

DON’T FORGET STATE TAXES

In addition to concerning themselves with federal taxes, gamblers need to deal with state income tax obligations. Some states allow deductions for losses, some do not. Some states allow for losses and wins to be netted, most do not.

Michigan, for example, changed its tax laws recently to allow for gambling loss deductions where there are winnings. Mississippi, meanwhile, has its 3% tax where the gaming establishment withholds a 3% “nonrefundable” tax at the time a W-2G-level jackpot is hit regardless of whether the winner is a state resident.

Casino customers from outside the country get separate treatment. In many cases, the United States has tax treaties with other countries that dictate how non-U.S. gamblers are treated from a tax perspective. For instance, in the United Kingdom, gambling winnings are not taxed and the U.S. tax treaty with the UK means that U.S. taxes are not withheld from those gambling customers.