Gambling in the USA

Twin River Worldwide Holdings, Inc. Announces 2018 Fourth Quarter And Full Year Results

Q4 REVENUE INCREASED 11.9% YEAR-OVER-YEAR

Twin River Worldwide Holdings, Inc. reported financial results for the fourth quarter and full year ended December 31, 2018.

Fourth Quarter and Full Year 2018 Highlights

- Net revenues for the fourth quarter and full year 2018 were $111.4 million and $437.5 million, respectively.

- Gross gaming revenues for the fourth quarter and full year 2018 were $183.5 million and $716.9 million, respectively. See reconciliation of this and other non-GAAP metics in the tables below.

- Fourth quarter and full year 2018 net income was $22.1 million and $71.4 million, respectively.

- Adjusted EBITDA for the fourth quarter and full year 2018 were $37.0 million and $165.7 million, respectively.

- Tiverton Casino Hotel (“Tiverton“) and the new hotel at Twin River Casino Hotel (“Twin River”) opened.

- The merger with Dover Downs Gaming & Entertainment, Inc. (“Dover Downs”) is expected to close in March 2019.

“We are pleased with the progress we made on our strategic initiatives in 2018. This past year was transformational for us, with the successful launch of our newest property, Tiverton, the successful opening and ramp of our new hotel at Twin River, the introduction of sports betting across our casino properties and the Dover Downs merger and related launch of TRWH as an NYSE-listed company. I am proud of our team’s focus and dedication to these initiatives without losing sight of our customers,” said George Papanier, President and Chief Executive Officer. “We are on track to close the Dover transaction this month, and our teams are hard at work planning for the integration to capture the synergies and strategic benefits of this combination for our combined shareholders.”

Summary of Fourth Quarter and Full Year Financial Results

|

Quarter Ended December 31, |

Year Ended December 31, |

||||||||||||||||

|

Amounts in $000’s |

2018 |

2017 |

Change |

2018 |

2017 |

Change |

|||||||||||

|

Net revenue |

$ |

111,422 |

$ |

99,554 |

11.9% |

$ |

437,537 |

$ |

421,053 |

3.9% |

|||||||

|

Income from operations |

34,697 |

27,990 |

24.0% |

120,649 |

123,723 |

-2.5% |

|||||||||||

|

Income from operations margin |

31.14% |

28.12% |

27.57% |

29.38% |

|||||||||||||

|

Net income |

22,130 |

19,154 |

15.5% |

71,438 |

62,247 |

14.8% |

|||||||||||

|

Net income margin |

19.86% |

19.24% |

16.33% |

14.78% |

|||||||||||||

|

Adjusted EBITDA |

36,980 |

38,535 |

-4.0% |

165,697 |

166,772 |

-0.6% |

|||||||||||

|

Adjusted EBITDA Margin |

33.19% |

38.71% |

37.87% |

39.61% |

|||||||||||||

2018 Fourth Quarter Results

Net revenues for the fourth quarter increased 11.9% to $111.4 million from $99.6 million in the fourth quarter of 2017. Net revenue increases were the result of the opening of Tiverton and the hotel at Twin River in September and October, respectively. Gaming revenues increased $8.5 million, or 11.3%, hotel revenues increased $1.6 million, or 38.2%, and food & beverage revenues increased $1.5 million, or 14.0%, each compared to the same period in the prior year.

Income from operations in the fourth quarter increased $6.7 million, or 24.0%, year-over-year to $34.7 million. This improvement can be attributed to operating income generated by the increased revenue and a $3.7 million decrease in advertising, general and administrative expenses (“AG&A”). The decrease in AG&A was primarily driven by a $12.8 million decrease reflecting reductions in share-based compensation expense, partially offset by merger and going public expenses and normal volume-related increases.

Net income for the fourth quarter increased by $3.0 million, or 15.5%, to $22.1 million due primarily to increased income from operations, partially offset by $1.8 million of increased interest expense and an increase in the effective tax rate from 17.2% to 20.9%.

Adjusted EBITDA for the fourth quarter of 2018 was $37.0 million, a decrease of $1.6 million, or (4.0%), from $38.5 million in the fourth quarter last year driven by increased corporate administrative expenses.

2018 Full Year Results

Net revenue for the year ended December 31, 2018 increased 3.9% to $437.5 million, from $421.1 million in the same period in 2017. This increase was primarily attributable to increases in gaming and racing revenue and non-gaming revenue attributable to the opening of Tiverton on September 1, 2018, partially offset by a decrease of $5.3 million from closing Newport Grand on August 28, 2018. The increase in non-gaming revenue can also be attributed opening the Twin River hotel and, to a lesser extent, due to increases in merchandise, cash services and entertainment revenue.

Total operating costs and expenses for the full year 2018 increased $19.6 million to $316.9 million from $297.3 million for 2017. This increase resulted in income from operations of $120.6 million, which represented a decrease of 2.5% compared to 2017. The year-over-year increase in costs and expenses can be attributed to $6.6 million of costs related to the Dover Downs merger and public company costs, a disposal loss of $6.5 million in connection with the sale of the Newport Grand land and building, a $3.7 million charge incurred associated with a pension plan withdrawal liability, an increase of $2.5 million in expansion and pre-opening costs primarily associated with Tiverton and increased marketing expense to support the opening of Tiverton and the Twin River hotel, partially offset by a $19.3 million reduction in the amount of share-based compensation expense.

Net income for 2018 was $71.4 million, an increase of 14.8% from $62.2 million in 2017. Contributing to the net income increase year-over-year was a reduction in the effective tax rate from 38.4% to 27.0% as a result of federal tax reform.

Adjusted EBITDA for the full year of $165.7 million was essentially the same as 2017.

Balance Sheet and Liquidity

TRWH had $77.6 million in cash and cash equivalents, excluding restricted cash, at December 31, 2018. Outstanding indebtedness at December 31, 2018 totaled $394.2 million including $55.0 million outstanding on the Company’s revolving credit facility. The Company’s leverage remained relatively consistent at approximately 2.4x compared to the prior year. Capital expenditures for Tiverton and Twin River hotel in 2018 totaled approximately $117 million.

Following the Dover Downs merger, the Company plans to consider a potential tender for a portion of its outstanding common stock or another transaction to provide a return of capital to shareholders. The amount, timing and terms of any such transaction, if any, will be determined at that time and be based upon prevailing market conditions, the Company’s financial condition and prospects and other factors, including conditions in the bank, credit and debt capital markets.

Reconciliation of GAAP Measures to Non-GAAP measures

To supplement the financial information presented on a generally accepted accounting principles (“GAAP”) basis, the Company has included in this earnings release non-GAAP financial measures for Adjusted EBITDA, Adjusted EBITDA margin, gross gaming revenue and leverage. The non-GAAP measure Adjusted EBITDA excludes depreciation, amortization, interest expense and income, net, income taxes, merger and going public expenses, loss associated with Newport Grand land and building disposal, acquisition-related costs associated with announced planned acquisitions in Colorado, pension withdrawal expense, pension audit payment, shared-based compensation expense, non-recurring litigation expenses, legal and financial expenses for strategic review, non-recurring expansion and pre-opening expenses, storm-related repairs, and credit agreement amendment expenses. Adjusted EBITDA margin is Adjusted EBITDA divided by net revenue. Gross gaming revenue is is net gaming revenue inclusive of the State of Rhode Island’s share of net terminal income, tables games revenue and other gaming revenue. Leverage is calculated as outstanding debt divided by Adjusted EBITDA as defined above.

The reconciliation of these non-GAAP financial measures to their comparable GAAP financial measures are presented in the tables appearing below. The presentation of non-GAAP financial measures is not intended to be considered in isolation or as a substitute for any measure prepared in accordance with GAAP. The Company believes that presenting non-GAAP financial measures aids in making period-to-period comparisons and is a meaningful indication of its actual and estimated operating performance. The Company’s management utilizes and plans to utilize this non-GAAP financial information to compare the Company’s operating performance to comparable periods and to internally prepared projections. The Company’s non-GAAP financial measures may not be the same as or comparable to similar non-GAAP measures presented by other companies.

Fourth Quarter and Full Year Conference Call

The Company’s fourth quarter and full year 2018 earnings conference call and audio webcast will be held today, Tuesday March 19, 2019 at 5:00 PM EDT. To access the conference call, please dial (877) 791-0146 (U.S. toll-free) and reference conference ID number 1562667. The webcast of the call will be available to the public, on a listen-only basis, via the Internet at the Investors section of the Company’s website at www.twinriverwwholdings.com. An online archive of the webcast will be available on the Company’s website for 120 days.

About Twin River Worldwide Holdings, Inc.

Twin River Worldwide Holdings, Inc., owns and manages two casinos in Rhode Island and one in Mississippi, as well as a Colorado horse race track that possesses 13 OTB licenses. Properties include Twin River Casino Hotel (Lincoln, RI), Hard Rock Hotel & Casino (Biloxi, MS), Tiverton Casino Hotel (Tiverton, RI) and Arapahoe Park (Aurora, CO). TRWH’s expertise spans various casino markets, including regional, destination & resort environments. Its casinos range in size from 1,000 slots and 32 table games facilities to properties with 4,200 slots and 123 table games, along with hotel and resort amenities.

Additional Information and Where to Find It

In connection with the proposed Dover Downs transaction, Twin River filed a registration statement on Form S-4 (File No. 333-228973) with the SEC that includes a combined proxy statement/prospectus. The registration statement was declared effective by the SEC on February 8, 2019, and a definitive proxy statement/prospectus was sent to each Dover Downs stockholder entitled to vote at the special meeting in connection with the proposed transaction beginning on February 13, 2019. This communication is not a substitute for any proxy statement, registration statement, prospectus or other documents Dover Downs and/or Twin River may file with the SEC in connection with the proposed Dover Downs transaction. INVESTORS ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THESE DOCUMENTS, ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS AND OTHER DOCUMENTS FILED BY DOVER DOWNS OR TWIN RIVER WITH THE SEC IN CONNECTION WITH THE PROPOSED DOVER DOWNS TRANSACTION BECAUSE THESE DOCUMENTS CONTAIN IMPORTANT INFORMATION. Investors are able to obtain free copies of these materials and other documents filed with the SEC by Dover Downs and/or Twin River through the website maintained by the SEC at www.sec.gov. Investors are also able to obtain free copies of the documents filed by Dover Downs and/or Twin River with the SEC from the respective companies by directing a written request to Dover Downs at Dover Downs Gaming & Entertainment, Inc., 1131 North DuPont Highway, Dover, Delaware 19901 or by calling (302) 857-3292, or contact Twin River at Twin River Worldwide Holdings, Inc., 100 Twin River Road, Lincoln, RI 02865 or by calling (401)-475-8474.

No Offer or Solicitation

This communication is for informational purposes only and not intended to and does not constitute an offer to subscribe for, buy or sell, the solicitation of an offer to subscribe for, buy or sell or an invitation to subscribe for, buy or sell any securities or the solicitation of any vote or approval in any jurisdiction pursuant to, or in connection with, the proposed transaction or otherwise, nor will there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities will be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”), and otherwise in accordance with applicable law.

Participants in the Solicitation

This communication is not a solicitation of a proxy from any investor. Dover Downs, its directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from stockholders of Dover Downs in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of proxies in connection with the proposed transaction, including a description of their direct or indirect interests, by security holdings or otherwise, are set forth in the relevant materials filed with the SEC. Information regarding the directors and executive officers of Dover Downs is contained in Dover Downs’ definitive proxy statement in respect of the Dover Downs transaction, its proxy statement for its 2018 annual meeting of stockholders, filed with the SEC on March 29, 2018, its annual report on Form 10-K for the year ended December 31, 2017, which was filed with the SEC on March 1, 2018, its quarterly report on Form 10-Q for the quarter ended September 30, 2018, which was filed with the SEC on November 8, 2018 and certain of its current reports filed on Form 8-K. These documents can be obtained free of charge from the sources indicated above.

Forward-Looking Statements

This communication contains “forward-looking” statements as that term is defined in Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995. All statements, other than historical facts, including future financial and operating results, the tax consequences of the transaction and the Company’s plans, objectives, expectations and intentions, legal, economic and regulatory conditions and any assumptions underlying any of the foregoing, are forward-looking statements.

Forward-looking statements concern future circumstances and results and other statements that are not historical facts and are sometimes identified by the words “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,” “believe,” “could,” “project,” “predict,” “continue,” “target” or other similar words or expressions. Forward-looking statements are based upon current plans, estimates and expectations that are subject to risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others (1) the risk that the proposed Dover Downs transaction may not be completed on the terms, in the time frame expected or at all; (2) unexpected costs, charges or expenses resulting from the Dover Downs and proposed Colorado transactions; (3) uncertainty of the expected financial performance of TRWH, including the failure to realize the anticipated benefits of transactions; (4) TRWH’s ability to implement its business strategy; (5) the inability to retain and hire key personnel; (6) the risk that stockholder litigation, result in significant costs of defense, indemnification and/or liability; (7) evolving legal, regulatory and tax regimes; (8) changes in general economic and/or industry specific conditions; (9) actions by third parties, including government agencies;(10) the risk that TRWH will be unable to complete any proposed capital return transaction on the terms, in the time frame expected or at all; and (11) other risk factors as detailed in the combined proxy statement/prospectus that was filed in a Registration Statement on Form S-4 with the SEC in connection with the Dover Downs transaction. The foregoing list of important factors is not exclusive.

Any forward-looking statements speak only as of the date of this communication. TRWH does not undertake any obligation to update any forward-looking statements, whether as a result of new information or development, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements.

|

TWIN RIVER WORLDWIDE HOLDINGS, INC. |

||||||||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited) |

||||||||||||

|

(in thousands, except per share data) |

||||||||||||

|

Quarter Ended December 31, |

Year Ended December 31, |

|||||||||||

|

2018 |

2017 |

2018 |

2017 |

|||||||||

|

Revenue: |

||||||||||||

|

Gaming |

$ |

83,825 |

$ |

75,288 |

$ |

327,740 |

$ |

314,794 |

||||

|

Racing |

2,718 |

3,152 |

13,158 |

14,034 |

||||||||

|

Hotel |

5,687 |

4,115 |

21,339 |

19,431 |

||||||||

|

Food and beverage |

12,465 |

10,935 |

48,380 |

47,004 |

||||||||

|

Other |

6,727 |

6,064 |

26,920 |

25,790 |

||||||||

|

Net revenue |

111,422 |

99,554 |

437,537 |

421,053 |

||||||||

|

Operating costs and expenses: |

||||||||||||

|

Gaming |

20,138 |

16,441 |

71,798 |

65,558 |

||||||||

|

Racing |

1,990 |

1,966 |

9,031 |

9,534 |

||||||||

|

Hotel |

2,352 |

1,713 |

8,266 |

7,173 |

||||||||

|

Food and beverage |

11,922 |

8,818 |

40,246 |

37,371 |

||||||||

|

Advertising, general and administrative |

33,507 |

37,229 |

156,023 |

155,336 |

||||||||

|

Expansion and pre-opening |

54 |

59 |

2,678 |

154 |

||||||||

|

Newport Grand disposal loss |

(27) |

– |

6,514 |

– |

||||||||

|

Depreciation and amortization |

6,789 |

5,338 |

22,332 |

22,204 |

||||||||

|

Total operating costs and expenses |

76,725 |

71,564 |

316,888 |

297,330 |

||||||||

|

Income from operations |

34,697 |

27,990 |

120,649 |

123,723 |

||||||||

|

Other income (expense): |

||||||||||||

|

Interest income |

53 |

52 |

173 |

194 |

||||||||

|

Interest expense, net of amounts capitalized |

(6,774) |

(4,910) |

(23,025) |

(22,809) |

||||||||

|

Total other expense |

(6,721) |

(4,858) |

(22,852) |

(22,615) |

||||||||

|

Income before provision for income taxes |

27,976 |

23,132 |

97,797 |

101,108 |

||||||||

|

Provision for income taxes |

(5,846) |

(3,978) |

(26,359) |

(38,861) |

||||||||

|

Net income |

22,130 |

19,154 |

71,438 |

62,247 |

||||||||

|

Deemed dividends related to changes in fair value of |

2,214 |

(668) |

640 |

(2,344) |

||||||||

|

Net income applicable to common stockholders |

$ |

24,344 |

$ |

18,486 |

$ |

72,078 |

$ |

59,903 |

||||

|

Net income per share, basic |

$ |

0.66 |

$ |

0.51 |

$ |

1.95 |

$ |

1.64 |

||||

|

Weighted average common shares outstanding, basic |

37,080,705 |

36,486,318 |

36,938,943 |

36,478,759 |

||||||||

|

Net income per share, diluted |

$ |

0.63 |

$ |

0.48 |

$ |

1.87 |

$ |

1.56 |

||||

|

Weighted average common shares outstanding, diluted |

38,503,938 |

38,485,001 |

38,551,708 |

38,442,944 |

||||||||

|

TWIN RIVER WORLDWIDE HOLDINGS, INC. |

||||

|

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) |

||||

|

(in thousands) |

||||

|

December 31, |

||||

|

2018 |

2017 |

|||

|

Assets |

||||

|

Current assets: |

||||

|

Cash and cash equivalents |

$ 77,580 |

$ 85,814 |

||

|

Restricted cash |

3,851 |

7,402 |

||

|

Accounts receivable, net |

22,966 |

18,311 |

||

|

Other current assets |

18,065 |

22,525 |

||

|

Total current assets |

122,462 |

134,052 |

||

|

Property and equipment, net |

416,148 |

335,548 |

||

|

Goodwill |

132,035 |

132,035 |

||

|

Intangible assets, net |

110,104 |

115,367 |

||

|

Other non-current assets |

1,603 |

1,132 |

||

|

Total assets |

$ 782,352 |

$ 718,134 |

||

|

Liabilities, Temporary Equity and Shareholders’ Equity |

||||

|

Current liabilities: |

||||

|

Current portion of term loan |

$ 3,595 |

$ 33,325 |

||

|

Accounts payable |

14,215 |

25,062 |

||

|

Accrued liabilities |

57,778 |

57,849 |

||

|

Total current liabilities |

75,588 |

116,236 |

||

|

Stock options |

– |

46,521 |

||

|

Deferred tax liability |

17,526 |

11,646 |

||

|

Revolver borrowings |

55,000 |

20,000 |

||

|

Term loan, net of current portion, discount and deferred financing fees |

335,578 |

337,875 |

||

|

Total liabilities |

483,692 |

532,278 |

||

|

Commitments and contingencies |

||||

|

Common stock subject to possible redemption |

– |

9,053 |

||

|

Shareholders’ equity: |

||||

|

Common stock |

380 |

362 |

||

|

Additional paid in capital |

125,629 |

67,910 |

||

|

Treasury Stock, at cost |

(30,233) |

(22,275) |

||

|

Retained earnings |

202,884 |

130,806 |

||

|

Total shareholders’ equity |

298,660 |

176,803 |

||

|

Total liabilities, temporary equity and shareholders’ equity |

$ 782,352 |

$ 718,134 |

||

|

TWIN RIVER WORLDWIDE HOLDINGS, INC. |

||||

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) |

||||

|

(in thousands) |

||||

|

Years Ended December 31, |

||||

|

2018 |

2017 |

|||

|

Cash flows from operating activities: |

||||

|

Net income |

$ 71,438 |

$ 62,247 |

||

|

Adjustments to reconcile net income to net cash provided by operating activities: |

||||

|

Depreciation and amortization |

22,332 |

22,204 |

||

|

Share-based compensation |

(1,474) |

17,791 |

||

|

Amortization of deferred financing fees |

2,400 |

2,205 |

||

|

Amortization of original issue discount |

867 |

1,082 |

||

|

Bad debt expense |

202 |

29 |

||

|

Deferred income taxes |

5,880 |

(5,126) |

||

|

Newport Grand disposal loss |

6,514 |

– |

||

|

Loss on disposal of property and equipment |

11 |

24 |

||

|

Changes in operating assets and liabilities |

1,074 |

7,376 |

||

|

Net cash provided by operating activities |

109,244 |

107,832 |

||

|

Cash flows from investing activities: |

||||

|

Repayment of loans from officers and directors |

5,360 |

362 |

||

|

Proceeds from sale of land and building for Newport Grand disposal |

7,108 |

– |

||

|

Capital expenditures, excluding Tiverton Casino Hotel and new hotel at Twin |

(11,874) |

(8,574) |

||

|

Capital expenditures – Tiverton Casino Hotel |

(94,581) |

(34,355) |

||

|

Capital expenditures – new hotel at Twin River Casino |

(22,435) |

(4,924) |

||

|

Other investing cash flows |

(1,178) |

6 |

||

|

Net cash used in investing activities |

(117,600) |

(47,485) |

||

|

Cash flows from financing activities: |

||||

|

Revolver borrowing |

41,000 |

10,000 |

||

|

Revolver repayments |

(6,000) |

(25,000) |

||

|

Term loan repayments |

(34,527) |

(11,564) |

||

|

Stock repurchases |

(7,958) |

(2,275) |

||

|

Other financing cash flows |

4,056 |

(94) |

||

|

Net cash used in financing activities |

(3,429) |

(28,933) |

||

|

Net change in cash and cash equivalents and restricted cash |

(11,785) |

31,414 |

||

|

Cash and equivalents and restricted cash, beginning of period |

93,216 |

61,802 |

||

|

Cash and equivalents and restricted cash, end of period |

$ 81,431 |

$ 93,216 |

||

|

TWIN RIVER WORLDWIDE HOLDINGS, INC. |

||||||||

|

Reconciliation of Net Income and Net Income Margin to |

||||||||

|

Adjusted EBITDA and Adjusted EBITDA Margin (Unaudited) |

||||||||

|

(in thousands) |

||||||||

|

Quarter Ended December 31, |

Year Ended December 31, |

|||||||

|

2018 |

2017 |

2018 |

2017 |

|||||

|

Net revenue |

$ 111,422 |

$ 99,554 |

$ 437,537 |

$ 421,053 |

||||

|

Net income |

$ 22,130 |

$ 19,154 |

$ 71,438 |

$ 62,247 |

||||

|

Depreciation and amortization |

6,789 |

5,338 |

22,332 |

22,204 |

||||

|

Provision for income taxes |

5,846 |

3,978 |

26,359 |

38,861 |

||||

|

Interest expense, net of interest income |

6,721 |

4,858 |

22,852 |

22,615 |

||||

|

Merger and going public expenses (1) |

2,292 |

– |

6,636 |

– |

||||

|

Newport grand disposal loss (2) |

(27) |

– |

6,514 |

– |

||||

|

Pension withdrawl expense (3) |

– |

– |

3,698 |

– |

||||

|

Expansion and pre-opening expenses (4) |

54 |

59 |

2,678 |

154 |

||||

|

Non-recurring litigation expenses (5) |

626 |

678 |

1,861 |

1,722 |

||||

|

Pension audit payment (6) |

1,400 |

– |

1,400 |

– |

||||

|

Share-based compensation |

(8,825) |

3,994 |

(1,474) |

17,791 |

||||

|

Legal & financial expenses for strategic review (7) |

4 |

226 |

676 |

822 |

||||

|

Credit agreement amendment expenses (8) |

83 |

– |

493 |

106 |

||||

|

Acquistion costs (9) |

208 |

– |

208 |

– |

||||

|

Storm related repair expense (10) |

(321) |

250 |

26 |

250 |

||||

|

Adjusted EBITDA |

$ 36,980 |

$ 38,535 |

$ 165,697 |

$ 166,772 |

||||

|

Net income margin |

19.86% |

19.24% |

16.33% |

14.78% |

||||

|

Adjusted EBITDA margin |

33.19% |

38.71% |

37.87% |

39.61% |

||||

|

(1) |

Merger and going public expenses primarily include legal and financial advisory costs related to the merger with Dover Downs and one-time costs of becoming a public company. |

|

(2) |

Newport Grand disposal loss represents the loss on the sale of the land and building, write-down of building improvements and write-off of equipment. |

|

(3) |

The pension withdrawal expense represents the accrual for the New England Teamsters Multi- employer pension plan withdrawal liability. |

|

(4) |

Expansion and pre-opening expenses represent costs incurred for Tiverton Casino Hotel prior to its opening on September 1, 2018. |

|

(5) |

Non-recurring litigation expense represents legal expenses incurred by TRWH in connection with certain litigation matters (net of insurance reimbursements). |

|

(6) |

Pension audit payments represents a charge for out-of-period unpaid contributions, inclusive of estimated interest and penalties, to one of the Company’s multi-employer pension plans. |

|

(7) |

Legal and financial expenses for the strategic review include expenses associated with TRWH’s review of strategic alternatives that began in April 2017. |

|

(8) |

Credit Agreement amendment expenses include costs associated with amendments made to TRWH’s Credit Agreement. |

|

(9) |

Acquisition costs represent costs incurred during the year associated with the Company’s announced acquisition of three casinos in Black Hawk, Colorado from Affinity Gaming. |

|

(10) |

Storm-related repair expenses include costs, net of insurance recoveries, associated with damage from Hurricane Nate at Hard Rock Biloxi. |

|

TWIN RIVER WORLDWIDE HOLDINGS, INC. |

||||||||||||

|

Calculation of Gross Gaming Revenue (Unaudited) |

||||||||||||

|

(In thousands) |

||||||||||||

|

Quarter Ended December 31, |

Year Ended December 31, |

|||||||||||

|

2018 |

2017 |

Change |

2018 |

2017 |

Change |

|||||||

|

Net gaming revenue |

$ 83,825 |

$ 75,288 |

11.3% |

$ 327,740 |

$ 314,794 |

4.1% |

||||||

|

Adjustment for the State of RI’s share of net |

99,710 |

86,774 |

389,203 |

370,604 |

||||||||

|

Gross gaming revenue |

$ 183,535 |

$ 162,062 |

13.3% |

$ 716,943 |

$ 685,398 |

4.6% |

||||||

|

(1) |

Adjustment made to show gaming revenue on a gross basis consistent with gross gaming win data provided throughout the gaming industry. |

|

Calculation of Leverage (Unaudited) |

||||

|

(In thousands, except times levered) |

||||

|

Year Ended December 31, |

||||

|

2018 |

2017 |

|||

|

Face Value of Debt (1) |

$ 397,439 |

$ 396,966 |

||

|

Adjusted EBITDA (2) |

165,697 |

166,772 |

||

|

Leverage |

2.4x |

2.4x |

||

|

(1) |

Outstanding debt before unamortized original issue discount and unamortized term loan deferred financing costs of $3.3 million and $5.8 million in 2018 and 2017, respectively. |

|

(2) |

See reconciliation of GAAP net income to Adjusted EBITDA above. |

Source: Twin River Worldwide Holdings, Inc.

Gambling in the USA

BetConstruct to Display Its Products and Services at Sigma Americas

BetConstruct, a leading company in iGaming technology and services, is heading to Sigma Americas in Sao Paulo, Brazil from April 23-25, 2024.

Sigma Americas is a major event focusing on iGaming with 10,000 delegations and more than 200 professional speakers. This event serves as an exceptional platform for participants to present their innovative offerings, engage with fellow industry leaders, and establish new business relationships.

BetConstruct is poised to introduce its cutting-edge products and solutions to the growing Brazilian market at the upcoming event. As a premier provider of online iGaming solutions, the company will showcase its comprehensive range of services to all attendees, offering diverse solutions tailored to meet their specific needs and preferences.

Moreover, BetConstruct will demonstrate its newest Spettacolare offer by Mr. First, which is a fleeting opportunity to maximise user profits and explore the potential of FTN.

Attendees of the event can find BetConstruct in the Transamerica Expo Center at Stand O60, where they will have the opportunity to gain a comprehensive understanding of BetConstruct’s products and solutions.

Gambling in the USA

Play’n GO announces expansion of BetMGM partnership with Pennsylvania launch

Swedish gaming giants’ games now live with leading US operator in Michigan, West Virginia, New Jersey, and the Keystone State

Play’n GO, the world’s leading casino entertainment provider, has today announced further expansion of its partnership with leading US operator BetMGM,with the Swedish gaming giant’s content now available with the group in Pennsylvania.

Play’n GO and BetMGM’s US partnership has already proven stunningly successful in Michigan, New Jersey, and West Virginia, and this expansion sees the partnership extend to a fourth US state. Having secured its Pennsylvanian gaming license in March, Play’n GO is now live with two operators in this key state. BetMGM players in Pennsylvania now have access to classic Play’n GO titles, such as Reactoonz.

Play’n GO is now licensed in six US states and is aiming to be active in every regulated market, in the US and around the world.

Magnus Olsson, Chief Commercial Officer at Play’n GO said: “We’re pleased to expand our partnership with BetMGM into a fourth US state, and look forward to continued success together. We have always been committed to a safe, regulation-led industry to secure a sustainable future for us all. BetMGM share our vision, and so are a perfect partner for us. We will continue our mission of being active in every regulated market around the world, and we’re excited for further growth opportunities well into the future, in the US and beyond.”

Gambling in the USA

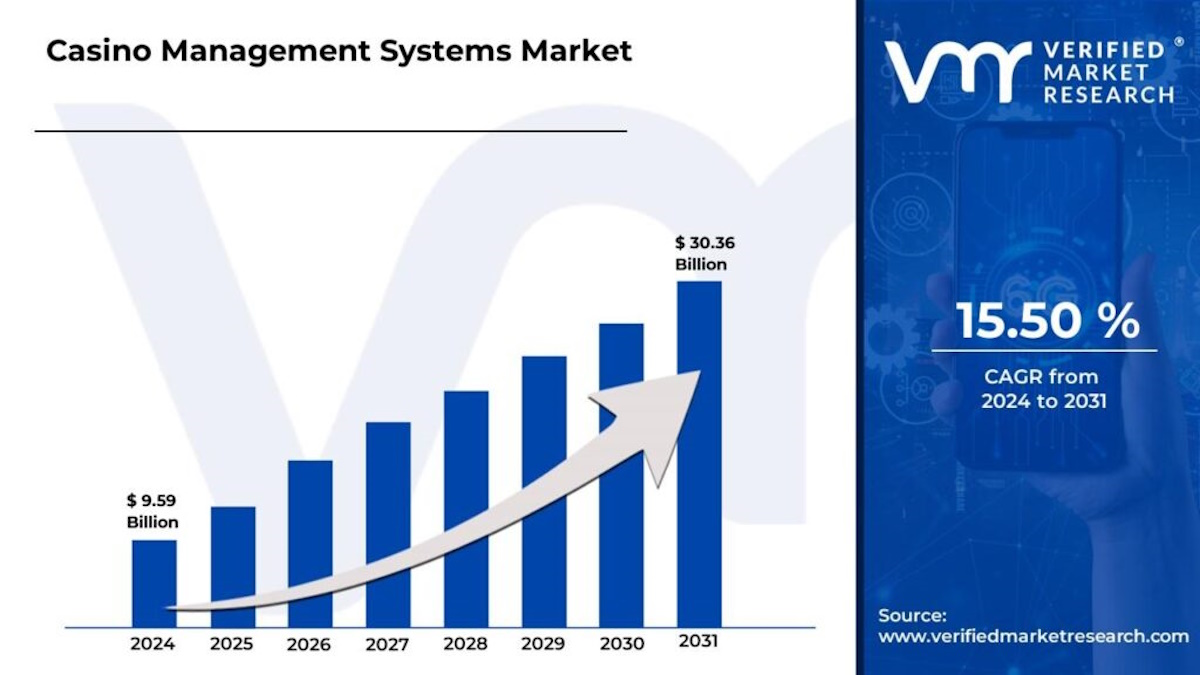

Casino Management Systems Market size worth $ 30.36 Billion, Globally, by 2031 at 15.5% CAGR – Report By Verified Market Research®

The Global Casino Management Systems Market is projected to grow at a CAGR of 15.5% from 2024 to 2031, according to a new report published by Verified Market Research®. The report reveals that the market was valued at USD 9.59 Billion in 2024 and is expected to reach USD 30.36 Billion by the end of the forecast period.

Scope Of The Report

| REPORT ATTRIBUTES | DETAILS |

| STUDY PERIOD | 2021-2031 |

| GROWTH RATE | CAGR of ~15.5% from 2024 to 2031 |

| BASE YEAR FOR VALUATION | 2024 |

| HISTORICAL PERIOD | 2021-2023 |

| FORECAST PERIOD | 2024-2031 |

| QUANTITATIVE UNITS | Value in USD Billion |

| REPORT COVERAGE | Historical and Forecast Revenue Forecast, Historical and Forecast Volume, Growth Factors, Trends, Competitive Landscape, Key Players, Segmentation Analysis |

| SEGMENTS COVERED |

|

| REGIONS COVERED |

|

| KEY PLAYERS | International Game Technology, Scientific Games Corporation, Everi Holdings Inc., NCR Corporation, Micros Systems, Konami Gaming, Light & Wonder, Astra Gaming Group, Novomatic AG Group, Gauselmann Group, Gamesys Group plc, BetConstruct, Melco Resorts & Entertainment, Galaxy Entertainment Group, SJM Holdings Limited, Suncity Group, Paradise Entertainment Limited |

| CUSTOMIZATION | Report customization along with purchase available upon request |

Casino Management Systems Market Overview

Technological Advancements Propel Growth: Technological advancements play a crucial role in driving the ever-changing Casino Management Systems Market. Advancements like AI-powered analytics, integration with IoT, and mobile compatibility contribute to improved operational efficiency and increased customer engagement. These advancements fuel the need for businesses to improve their operations and provide exceptional customer experiences, leading to the growth of the market.

Rising Demand for Enhanced Security Solutions: Security is a major concern in the Casino Management Systems Market, leading to a high demand for cutting-edge security solutions. Given the rising number of fraudulent activities and data breaches, casinos are actively looking for strong security measures to protect their assets and ensure the safety of customer information. Addressing these concerns, solutions that provide biometric authentication, encryption, and real-time monitoring can foster trust among stakeholders and contribute to market growth.

Increasing Regulatory Compliance Requirements: The Casino Management Systems Market is seeing a notable increase in demand due to the growing importance of regulatory compliance. Comprehensive compliance solutions are required to meet the stringent regulations in the gaming industry. By utilising systems that provide regulatory reporting, audit trails, and age verification capabilities, casinos can ensure compliance with legal requirements and prevent potential penalties. The increasing emphasis on compliance highlights the significance of advanced management systems, driving the growth of the market.

High Initial Investment Costs: One of the main challenges in the Casino Management Systems Market is the significant upfront costs involved in implementing comprehensive management solutions. Acquiring, integrating, and customising these systems can result in significant upfront expenses for casinos. The financial obstacle hinders the expansion of the market, especially for small and medium-sized businesses. Nevertheless, companies that offer adaptable pricing structures and scalable solutions can help alleviate this limitation, thereby expanding the market’s accessibility to a wider array of businesses.

Integration Challenges and Legacy Systems: The Casino Management Systems Market faces significant challenges due to the complexities of integration and the presence of legacy systems. It is common for casinos to have a wide range of IT infrastructures, some of which may be outdated and incompatible with modern management solutions. Implementing new systems and ensuring smooth compatibility with current infrastructure demands significant time, resources, and specialised knowledge. The integration challenges mentioned can impede market growth as they result in longer implementation timelines and higher deployment costs.

Concerns Regarding Data Privacy and Security: In the ever-growing landscape of data breaches and privacy scandals, the Casino Management Systems Market faces significant challenges when it comes to data privacy and security. Casinos are responsible for managing extensive amounts of sensitive customer data, which includes personal and financial information. This makes them highly attractive to cyber threats. With increasing regulatory scrutiny, casinos are under growing pressure to maintain data protection standards and ensure the privacy of their customers. Tackling these concerns necessitates strong security measures and adherence to data privacy regulations, which introduces additional complexity and expenses to system implementations, thereby limiting market expansion.

Geographic Dominance:

The forecast period is expected to see the Asia Pacific region experiencing the most significant growth. Several countries in the Asia Pacific region, such as Macau, Singapore, the Philippines, and South Korea, have experienced significant expansion in their casino industry. Emerging markets are actively expanding their gaming sectors in order to attract more tourists and boost revenue. This expansion requires sophisticated management systems to optimise operations, enhance visitor experiences, and ensure compliance with regulations.

In addition, the Asia-Pacific region has experienced a notable rise in middle-class populations and disposable incomes. As a result, there has been a growing trend of increased leisure spending, with a particular focus on gaming and entertainment. With the increasing number of casino visitors, there is a growing need for cutting-edge casino management systems. This has led to the creation of innovative technologies that enhance customer service, marketing strategies, and overall operational efficiency.

Casino Management Systems Market Key Players Shaping the Future

Major players, including International Game Technology, Scientific Games Corporation, Everi Holdings Inc., NCR Corporation, Micros Systems, Konami Gaming, Light & Wonder, Astra Gaming Group, Novomatic AG Group, Gauselmann Group, Gamesys Group plc, BetConstruct, Melco Resorts & Entertainment, Galaxy Entertainment Group, SJM Holdings Limited, Suncity Group, Paradise Entertainment Limited. and more, play a pivotal role in shaping the future of the Casino Management Systems Market. Financial statements, product benchmarking, and SWOT analysis provide valuable insights into the industry’s key players.

Casino Management Systems Market Segment Analysis

Based on the research, Verified Market Research® has segmented the global Casino Management Systems Market into Module, Application, And Geography.

- Casino Management Systems Market, by Module

- Slot Games

- Table Games

- Casino Management Systems Market, by Application

- Accounting

- Security & Surveillance

- Players Tracking

- Marketing & Promotions

- Gaming Analytics

- Others

- Casino Management Systems Market, by Geography

- North America

- U.S

- Canada

- Mexico

- Europe

- Germany

- France

- U.K

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- ROW

- Middle East & Africa

- Latin America

- North America

Leading Casino Management Systems taking gambling to new heights

Visualize Casino Management Systems Market using Verified Market Intelligence -:

Verified Market Intelligence is our BI Enabled Platform for narrative storytelling in this market. VMI offers in-depth forecasted trends and accurate Insights on over 20,000+ emerging & niche markets, helping you make critical revenue-impacting decisions for a brilliant future.

VMI provides a holistic overview and global competitive landscape with respect to Region, Country, Segment, and Key players of your market. Present your Market Report & findings with an inbuilt presentation feature saving over 70% of your time and resources for Investor, Sales & Marketing, R&D, and Product Development pitches. VMI enables data delivery In Excel and Interactive PDF formats with over 15+ Key Market Indicators for your market.

-

Latest News5 days ago

Latest News5 days agoLight & Wonder Taps Trustly to Power Cashless Payments at Casinos

-

Latest News4 days ago

Latest News4 days agoKingMidas Games Unveils Cutting-Edge Range of Multiplayer Games

-

Latest News2 days ago

Latest News2 days agoAEG and Yaamava’ Resort & Casino at San Manuel Announce 16th Year in Partnership, Shaping the Future of Sports and Live Entertainment Across Southern California

-

Canada2 days ago

Canada2 days agoGiG increases Ontario market presence, powering the launch of Casino Time

-

Latin America2 days ago

Latin America2 days agoCGS Events Revolutionizes the Chilean Gaming Scene with the Launch of CGS Santiago in its Fourth Edition

-

Latin America1 day ago

Latin America1 day agoBetby Forges Strategic Partnership With Latam Powerhouse Cactus Gaming

-

Gambling in the USA1 day ago

Gambling in the USA1 day agoPlay’n GO announces expansion of BetMGM partnership with Pennsylvania launch

-

Latest News4 days ago

Latest News4 days ago7JP Bolsters Team with Strategic New Hires Ahead of Brazilian Market Expansion