$2.5 Trillion Dollar Millennial Megawave Drives Boom in Video Games and Sports Betting: CEOs of Electronic Arts, FansUnite, ESE Entertainment, and Penn National Discuss New Paradigms of Interactive Entertainment

Wall Street Reporter, the trusted name in financial news since 1843, has published reports on the latest comments and insights from leaders at: FansUnite, Electronic Arts, ESE Entertainment, and Penn National Gaming.

“Video games have replaced music as the most important aspect of youth culture” is the headline of a recent article in The Guardian, which parallels recent reporting in The Washington Post, and New York Times, highlighting new paradigm shifts in entertainment and consumer behavior. Millennials and GenZ now have $2.5 trillion in spending power, replacing Baby Boomers as the dominant consumer force. The global video gaming industry took in an estimated $180bn in 2020 – more than sports and movies worldwide. The new generation prefers interactive forms of entertainment such as video games and online sports betting. Younger generations left behind traditional media for social media over the past decade – and now they are leaving behind social media for more interactive experiences. Wall Street Reporter highlights the latest comments from industry thought leaders:

“…After the biggest first quarter in the history of Electronic Arts, our second quarter of FY 2021 showed continued strength with net revenue and earnings above our guidance. We are driving growth through the breadth, depth and quality of our new games, our industry-leading live services and expansion to more platforms and more ways to play… We delivered eight new games so far this year, and our network has grown to more than 330 million unique accounts as tens of millions of new players have joined to enjoy more of our amazing games and content. EA SPORTS continues to be a leader in sports interactive entertainment…

“…Our esports programs are scaling the new records in viewership also. Our new Madden NFL episodic content featuring NFL athletes, celebrities and top Madden NFL players is bringing great entertainment to a much wider audience. And our recent FIFA 21 challenge, which paired esports stars with celebrity soccer players was our most-watched esports event to date, with viewership that places it among top esports broadcast worldwide.

“A few thoughts on our growth drivers for FY 2022 and beyond: Each previous console generation has grown in the global market and we expect this transition will be the same. We plan to launch at least six new games on the next-gen consoles in FY 2022. These will include a new Need for Speed game that is bringing some astounding visual leaps, developed by the Criterion team who have launched some of the most highly-rated games in franchise history…”

In a recent presentation at Wall Street Reporter’s NEXT SUPER STOCK livestream, FansUnite (OTC: FUNFF) (CSE: FANS) CEO Scott Burton explained how the company’s latest distribution deal with an online casino games aggregator sets the stage for exponential revenue growth opportunities. In the next 12 months, FUNFF plans to expand its current line from three games to twelve – while adding multiple aggregators for each game – reaching millions of new online casino customers worldwide. With each game generating as much as $500,000 in revenue per month for FUNFF – per online casino – and the potential to be in hundreds of online casinos – these numbers can quickly add up.

January 11 – FUNFF closes an oversubscribed C$13.4 million private placement driven by strong investor demand. “The successful closing of this upsized financing provides further validation that the global gambling market is seeing a resurgence in demand from investors,” said Scott Burton, CEO of FansUnite. “Despite the headwinds caused by the global pandemic in 2020, we saw consumers adopt and embrace online betting for its ease of access and simplicity. With our seasoned team of gaming operators, global B2C brands, and our industry adopted B2B technology platform, we were able to execute on multiple milestones that delivered value to our customers and shareholders. As we now look to advance our operations globally, we believe this additional capital will allow us to explore strategic initiatives and execute on our vision of becoming a globally recognized iGaming leader.”

December 16 – FUNFF gains first-mover advantage into the U.S. esports betting market, as its long-term partner GameCo joins US Bookmaking and Sky Ute Casino to establish the first dedicated esports sportsbook in the United States. FUNFF wholly-owned subsidiary Askott Entertainment will supply its iGaming platform, Chameleon, as part of a fully integrated esports betting solution. Through GameCo’s partnership with Sky Ute Casino and US Bookmaking, FansUnite will be the first iGaming solutions provider to receive significant exposure in the U.S. esports betting market.

December 7 – FUNFF receives Malta Gaming Service License and Critical Gaming Supply, and will now be able to offer a full spectrum of online gambling services in Europe, covering Casino, Fixed Odds Betting, Pool Betting and Controlled Skilled Games. With MGA approval received, FansUnite will be joining other highly respected gambling companies such as PokerStars, Betfair and Unibet in operating their business within MGA regulations.

ESE Entertainment (TSX.V: ESE) (OTC: ENTEF) CEO, Konrad Wasiela, a featured presenter at Wall Street Reporter’s NEXT SUPER STOCK investors livestream conference, shares his vision for building ESE into the dominant player in the multi-billion dollar global E-Sports market. ESE is now rapidly expanding, with multiple revenue streams, including E-Sports infrastructure software powering global tournaments, exclusive digital media distribution, broadcast rights, and owning world-class leagues and teams, including its K1CK global E-Sports franchise.

In his interview with Wall Street Reporter, ESE CEO, Konrad Wasiela, says the company is now ready to scale – expanding its global footprint, with new partnerships with global brands like Porsche, driving revenue growth with aggressive focus on top line sales and margin expansion, and M&A opportunities.

January 8 – ESE announces Actina, a leading gaming hardware brand, is sponsoring ESE’s K1CK e-sports team for the 2021 season. The League of Legends K1CK team Competes in Ultraliga, a Riot Games licensed league that is broadcasted on national TV in Poland on the Polsat Games Channel.

December 24 – ESE closes an oversubscribed private placement of C$3.6 million.

December 17 – ESE announces that Nuvei Corporation (NVEI), a leading global payment technology company, will be the title sponsor for ESE’s K1CK e-sports team for all of its competitions for the 2021 season, across League of Legends, FIFA, Apex Legends, and more.

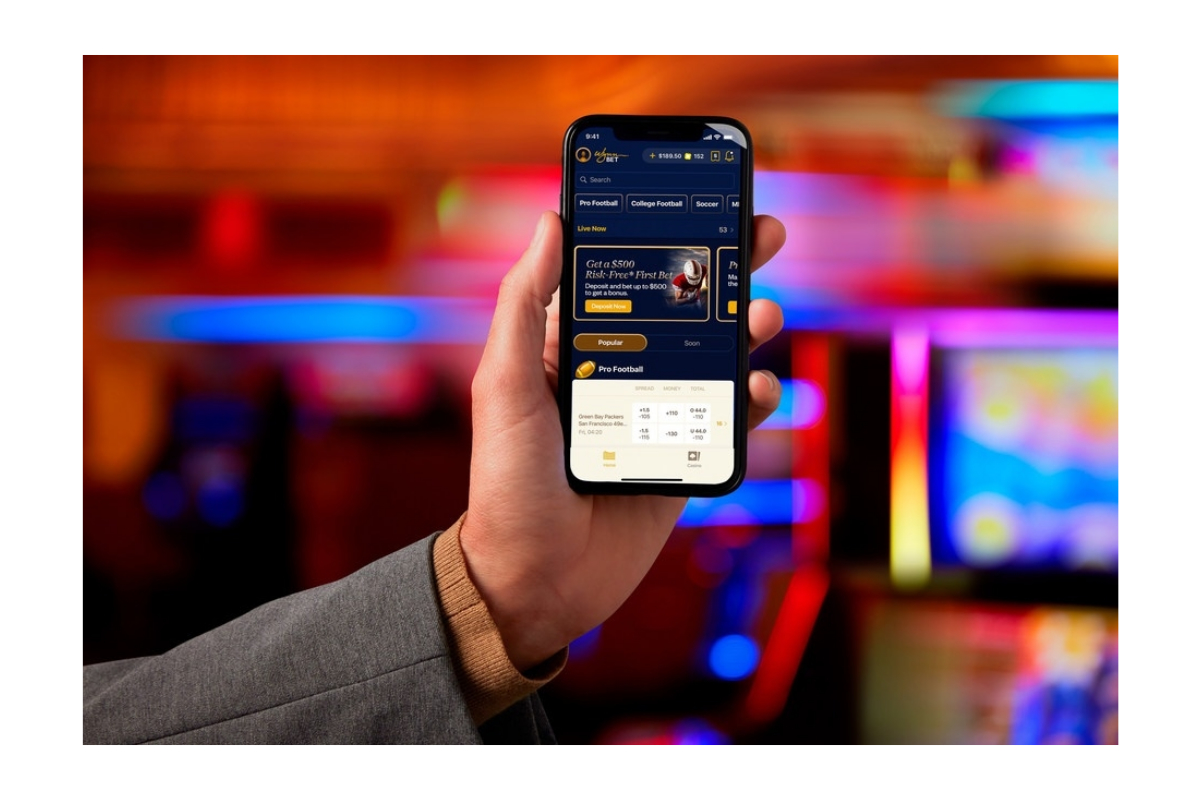

“…we’re most excited about the potential for significant long-term growth and value creation through our highly differentiated omnichannel strategy. To that end, we look forward to the launch of our Barstool Sportsbook mobile app in September here in Pennsylvania. We think Barstool’s loyal followers and our existing casino guests will greet unlike anything in the market today… Our Hollywood branded real money iCasino product in Pennsylvania continues to grow nicely even after the reopening of our casinos the last couple of months, with a meaningful portion of our revenues coming from our inactive database. Our proven ability to convert our casino database, together with our partnership with Barstool Sports, will provide significant organic customer acquisition and cross-sell opportunities. In sum, we believe we are extremely well-positioned to capture an outsized share of the growing US sports betting and iCasino market… Despite the ongoing uncertainties with this pandemic, we’re extremely excited for the future and believe all the seeds we planted throughout 2020 will provide a strong foundation for new growth and opportunity ahead.

“…we’ve taken our time to launch Barstool because we’re launching a very competitive product with things like traveling wallet. I think our bet flip experience is second to none, the intuitiveness of how to use the app, and importantly the exclusive betting options, are really the differentiation that we’re going to I think be able to deliver, it’s going to get better over time, but even day one – and I am not going to get too much detail here because we’re yet to see it when we launch it. You’re going to see a lot of opportunities to engage with Dave Portnoy, and Big Cat, and Brandon Walker, and Marty Mush, and many others at Barstool – if you want, bet with them, or you want to bet against them, if you want to save their bets. These are things we’re going to be able to do day one and I think you should imagine that the content and the branding integration into our app with Barstool is just going to get better and better and better every time we do a version release, and we think that we’ll be able to do a new version release probably every six weeks after we launch, so I’m excited about everything…”