How Venezuela’s iGaming market is reacting to US pressure

Blask data indicates Venezuela’s iGaming demand remained stable in the initial days following the US operation in Caracas.

On 3 January, US forces detained Venezuelan president Nicolás Maduro, transporting him from Caracas to face prosecution in New York. The raid came after months of intensifying American pressure throughout 2025 — naval presence, targeted strikes, and a fresh sanctions package.

For Venezuela’s iGaming sector, the disruption poses a critical question: will demand collapse, or adapt?

First results

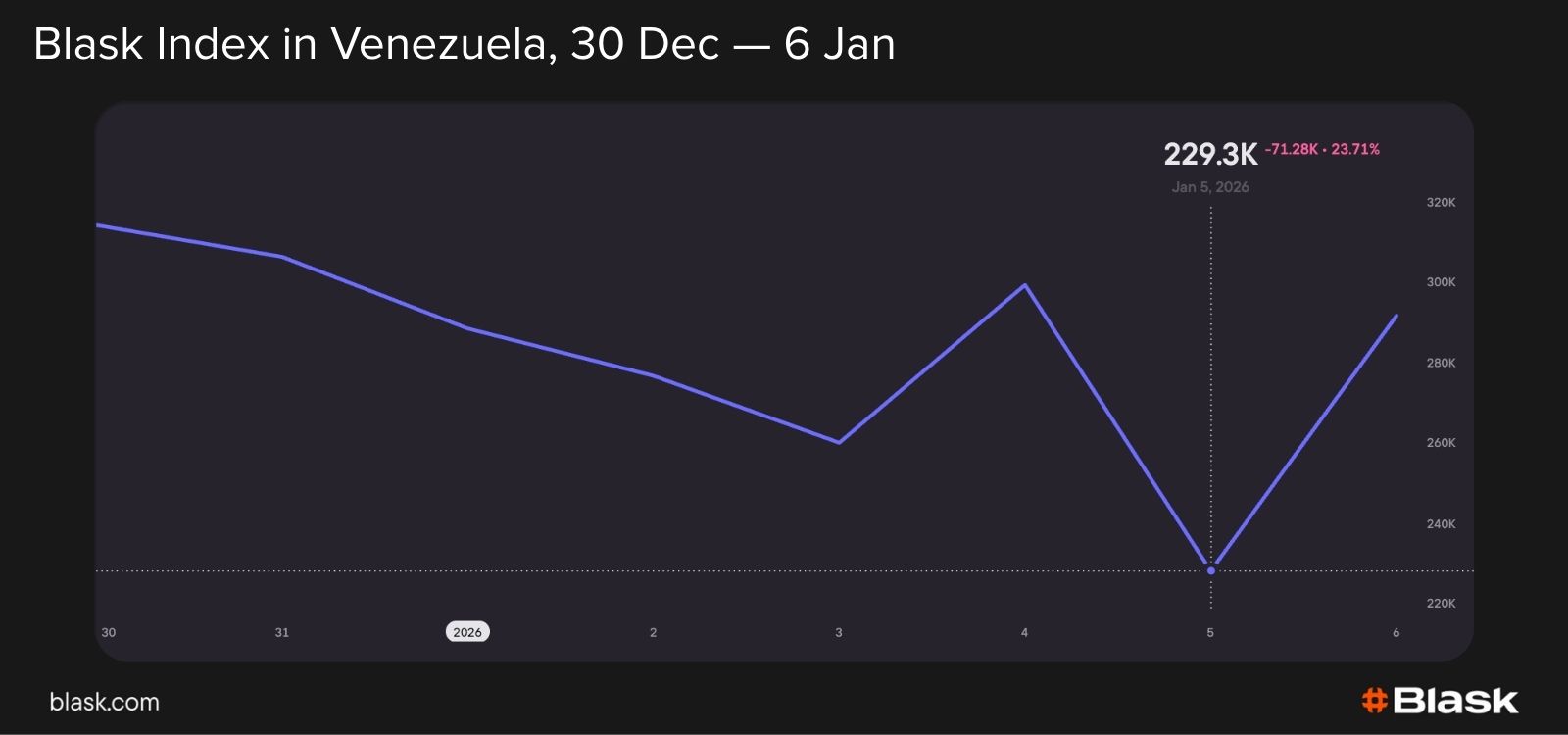

Blask’s daily Index remained within a tight corridor from 1–4 January, hovering in the high-200K zone. It dropped 5% to 257.4K on the day of the operation, before recovering the next day.

The data reveals no abrupt demand shift during this period. A slight decline sits within Venezuela’s normal daily fluctuations and does not point to a fundamental market change.

Rapid expansion, growing dominance

Venezuela stood out as one of iGaming’s strongest demand gainers in 2025. Blask Index surged 134.9% year-on-year — the second-highest growth worldwide.

This expansion came alongside increasing market dominance. By December, Triunfo Bet commanded 59% of Blask’s BAP (Brand Accumulated Power, measuring a brand’s portion of total user interest nationally), gaining 15 percentage points since January. The top three brands collectively reached over 85%, up 11 points.