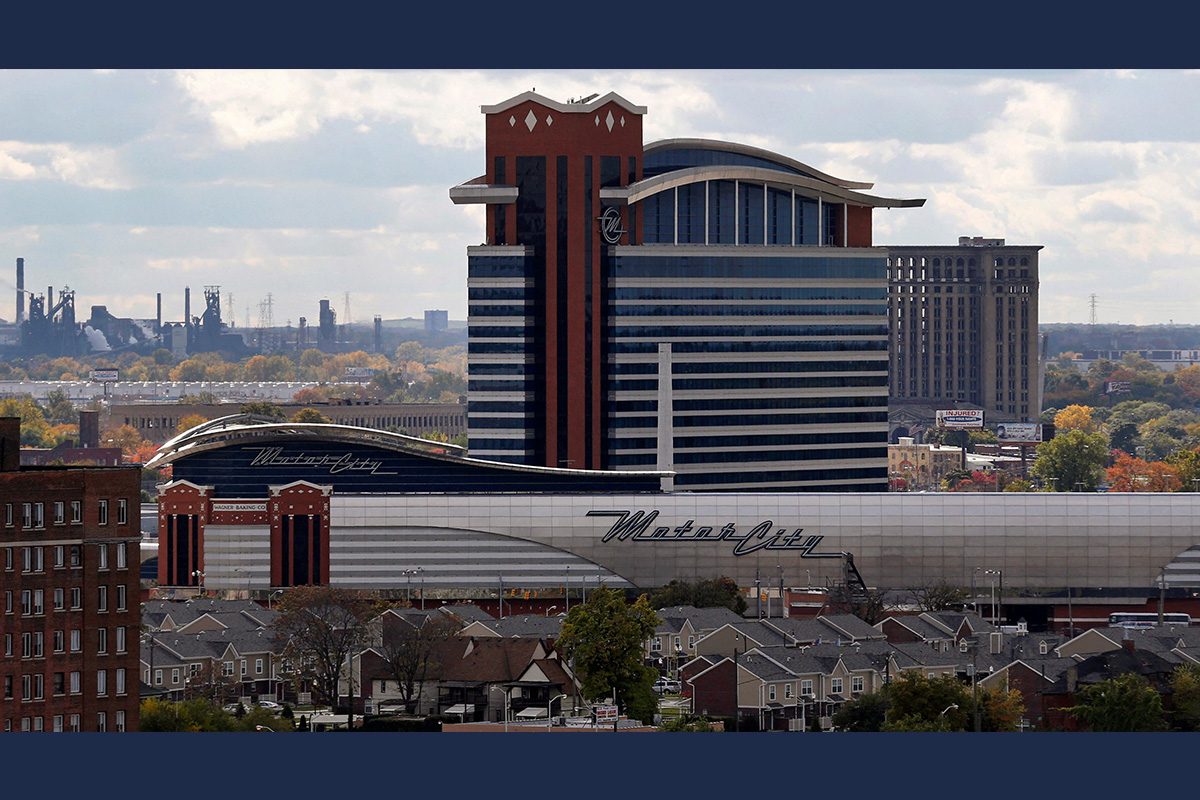

Detroit Casinos Report $82.8M in October Revenue

The three Detroit casinos reported $82.8 million in monthly aggregate revenue (AGR) for the month of October 2023, of which $81.7 million was generated from table games and slots, and $1.1 million from retail sports betting.

The October market shares were:

- MGM, 46%

- MotorCity, 31%

- Hollywood Casino at Greektown, 23%

Table Games and Slot Revenue and Taxes

October 2023 table games and slot revenue decreased 18.9% when compared to October 2022 results. October monthly revenue was 18.3% lower than September 2023. From January 1 through Sept. 30, the Detroit casinos’ table games and slots revenue decreased by 1.3% compared to the same period last year.

The casinos’ monthly gaming revenue results all decreased compared to October 2022:

- MGM, down 19.6% to $37.3 million

- MotorCity, down 22.8% to $25 million

- Hollywood Casino at Greektown, down 11.7% to $19.4 million

During October, the three Detroit casinos paid $6.6 million in gaming taxes to the State of Michigan. They paid $8.2 million for the same month last year.

The casinos reported submitting $10.1 million in wagering taxes and development agreement payments to the City of Detroit in October.

Retail Sports Betting Revenue and Taxes

The three Detroit casinos reported $18.1 million in total retail sports betting handle, and total gross receipts were $1.1 million for the month of October.

Retail sports betting qualified adjusted gross receipts (QAGR) were down 46.3% when compared to October 2022. October QAGR was down by 28.6% compared to September 2023.

October QAGR by casino was:

- MGM: $365,705

- MotorCity: $669,028

- Hollywood Casino at Greektown: $90,430

During October, the casinos paid $42,531 in gaming taxes to the state and reported submitting $51,982 in wagering taxes to the City of Detroit based on retail sports betting revenue.

Fantasy Contests

For September, fantasy contest operators reported total adjusted revenues of $2.1 million and paid taxes of $178,346.

From Jan. 1 through Sept. 30, fantasy contest operators reported $16.8 million in aggregate fantasy contest adjusted revenues and paid $1.4 million in taxes.