Gambling in the USA

More UK Casinos Likely to Move into the US in the Near Future

The UK gambling market may be one of the largest in the industry, but it’s also one of the strictest in world. Over the past few years, the Gambling Commission has placed more restrictions on online casino and betting operators. This has prompted several big brands in the United Kingdom to consider expanding their businesses overseas in the growing US gambling market.

That being said, it’s not only tighter regulations that has caused UK betting and online casino site operators to show interest in the evolving American gambling market. Financial gain is another driving force for UK companies. Ever since 2018 when the US Supreme Court overturned the federal ban on sports betting in America, several states legalized it and began offering both online casino and online sports betting activities. Currently, online casinos are legal in 6 states and online sports betting is legal in 21 states, and more states are expected to legalize some form of online gambling activity in the future.

As gambling becomes legalized throughout America, its popularity grows, as does its revenue. According to the American Gaming Association, although December revenue has yet to be reported for 2021, the US’ annual gaming revenue for 2021 reached $48.34 billion through the end of November. This number crushed the industry’s 2019 full-year record of $43.65 billion. What’s more, this eleven-month period in 2021 tracked 21.3% ahead of the same eleven-month period in 2019.

Long-time UK Brands Compete Over US Market

Wanting a piece of this profitable pie, a number of UK gambling firms have seized the opportunity to break into the growing lucrative market. The primary goal: either to become a valuable business partner with an American gambling giant or to be a takeover target. Notable examples of UK gambling firms that are making their mark in the USA include:

Entain

Entain PLC, the UK owner of popular casino and betting brands Ladbrokes and Coral, entered into a $200 million deal with American hospitality and entertainment company MGM Resorts back in 2018 to capitalise on the newly liberalized sports betting market in the US.

Fast forward a few years later and the latest projected deals reveal that major American sports betting company, DraftKings, sought to acquire Entain for $22 billion in cash and stock in September 2021. However, this offer, as well as a previous offer of $11 billion from MGM Resorts to acquire Entain back in January 2021, were rejected. According to MGM – Entain’s joint venture partner – a DraftKings acquisition of Entain would require the consent of BetMGM due to DraftKings owning a competing business in the US.

Flutter

Also wanting to bolster its assets in the United States, Flutter Entertainment – owner of PaddyPower and Betfair – acquired FanDuel in 2018, one of the leading daily fantasy sports operators in the US at the time. Later, in 2019, Flutter merged with Canadian company The Stars

Group. With the merger, Flutter expanded further into the US, as media giant Fox corporation – which owned a minority stake in The Stars Group – took a 2.6% minority stake in Flutter Entertainment. Moreover, the merger resulted in the creation of the largest online gambling company in the world based on revenues.

Today, Flutter holds a 95% stake in FanDuel, which offers daily fantasy sports, sportsbook, online casino and horse racing products in several states. FanDuel is also the leader in the US online sports betting industry, with 40% of the market share.

William Hill

William Hill, another huge UK brand well known for its online casino and sportsbook, also made headlines in the industry with a major US gambling deal. Instead of partnering with an American company or acquiring one however, William Hill was purchased by American hotel and entertainment company Caesars Entertainment. William Hill agreed to the £2.9 billion ($3.9 billion) takeover bid by the Nevada-based casino operator in September 2020, after previously turning down two rival bids by another US company, Apollo, a private equity group.

Caesars completed its acquisition of William Hill in April 2021, after which William Hill was delisted from the London Stock Exchange. Later in September of that same year, Caesars sold all of William Hill’s non-US assets to 888 Holdings for £2.2 billion ($2.9 billion). In the US, William Hill sportsbooks were rebranded to Caesars Sports.

What is in Store for 2022

This year, it is likely that more deals will occur between the two nations as the world slowly comes out of the clutches of the pandemic and more US states pass laws to legalize gambling within their borders. Both UK gambling operators and US gambling operators have plenty of benefits to offer the other.

Gambling in the USA

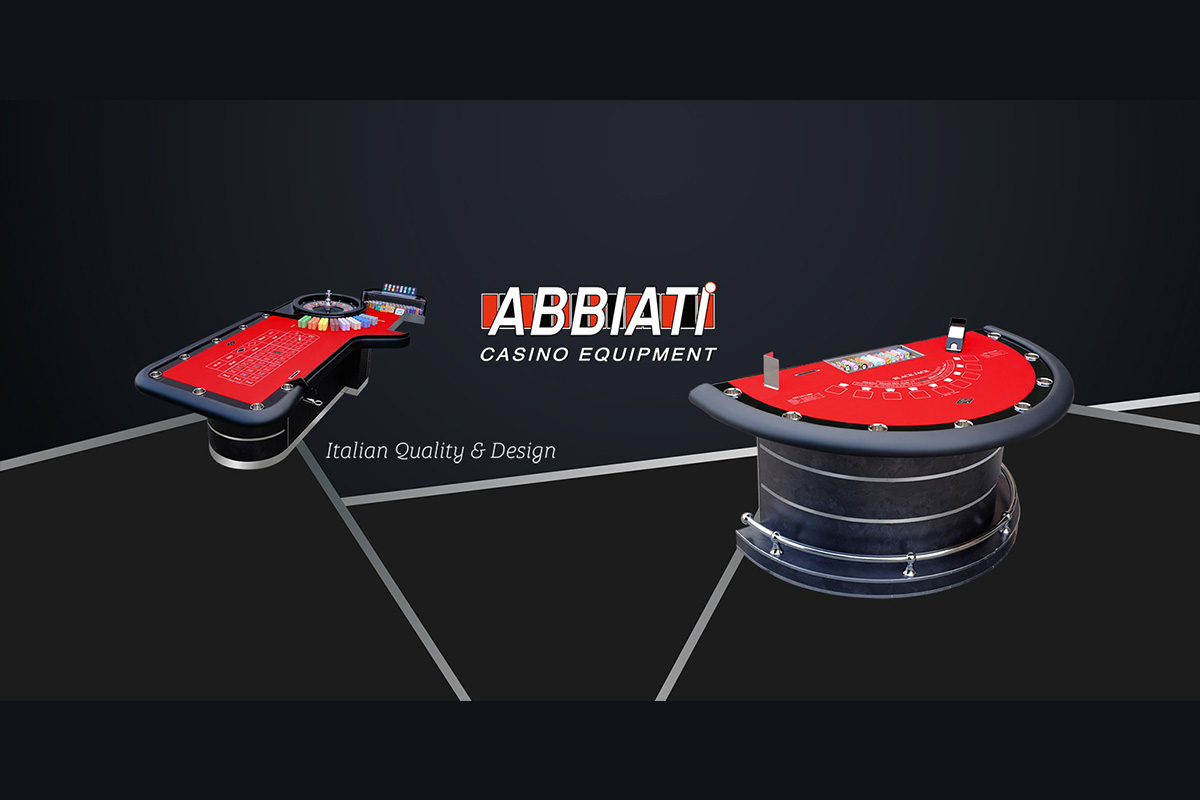

Abbiati Casino Equipment and Hawkins Holdings Form Strategic Alliance to Expand Presence Across the Americas

Abbiati Casino Equipment, a globally recognised leader in premium casino equipment and technologies, announced a strategic partnership with Hawkins Holdings to strengthen its presence across North and South America. As part of this initiative, seasoned gaming executive Roger Hawkins has been appointed Brand Ambassador and Strategic Consultant for the Americas.

With more than 20 years of executive leadership in the global casino and gaming industry, Hawkins will spearhead the company’s efforts to expand its footprint throughout the Western Hemisphere. His role will include market development, strategic partnerships, regulatory positioning, and the promotion of Abbiati’s legacy of Italian innovation, craftsmanship, and integrity.

“This partnership is about more than market entry – it’s about building deeper awareness, driving product adoption, and reinforcing Abbiati’s commitment to quality across every pit and poker room in the hemisphere,” said Hawkins.

Giorgio Abbiati, CEO of Abbiati Casino Equipment, said: “We have proudly served clients in the Americas for many years, but the time is right to deepen our focus. Roger’s knowledge of our products and his insight into the market make him the ideal partner to lead this next phase.”

Gambling in the USA

Catawba Two Kings Casino Resort Rising in Kings Mountain as First Year of Construction is Completed

Significant construction has been completed during the first year of work on the $1 billion Catawba Two Kings Casino Resort in Kings Mountain, N.C., a site off Interstate-85 only 35 miles from Charlotte and close to the South Carolina border.

Construction on all aspects of the project is in full swing, with the foundations for the casino complex and hotel completed several months ago, the casino complex at its full height and expanding horizontally, and steel continuing to rise for the 24-story, 385-room hotel. The hotel tower framing is now 10 stories high, with an additional floor being added nearly every week. At completion, the hotel will be connected to the casino complex.

The casino complex includes the introductory casino on the first level, three levels of covered parking, a back-of-house level and top level with the main casino floor and restaurants. The introductory casino, set to open in spring 2026, will include 1350 slot machines, 20 table games, a 40-seat restaurant, a bar, sports betting kiosks, and Lucky North Rewards desk.

The introductory casino will replace the current temporary (prelaunch) casino, which continues to grow in popularity as it nears its fourth anniversary on July 1.

The main casino complex is targeted to open in 2027. It will be about 2 million square feet and feature:

• 4300 slot machines

• 100 table games

• 11 dining outlets, including a steakhouse, Italian restaurant, marketplace with six venues, café, and grab-and-go outlet

• A players lounge

• 11 bars, including a center bar and sports bar

• A 2700-space parking garage built under the casino complex and 800 surface parking spaces

The project has created hundreds of construction jobs. Upon completion, the casino resort will employ an estimated 2200 regional residents and citizens of the Catawba Nation.

“This casino resort will be an economic game changer for Catawba citizens and a force to drive the economy of Cleveland County and the City of Kings Mountain. This project is a testament to our resilience, our commitment to self-sufficiency, and our determination to build a better future for ourselves and our future generations,” Catawba Nation Chief Brian Harris said.

Harris noted the temporary casino is contributing to many community and charitable organizations in the region, and that will only increase as the full casino resort opens.

The project is being led by the Catawba Nation Gaming Authority under Vice President Trent Troxel, with Yates-Metcon as the construction general contractor; Delaware North as the gaming management, development and hospitality consultant; and SOSHNY Design architects.

“Once again, I want to thank the Cleveland County, City of Kings Mountain, federal and state leaders who have supported the Catawba Nation’s efforts develop the casino resort in its ancestral lands in North Carolina,” Harris said.

Work has also been completed on two key infrastructure projects for development of the permanent casino resort that were funded by the Catawba Nation: doubling the size of the Dixon School Road Bridge over I-85 near the casino entrance and installing new sewer lines near the casino.

Gambling in the USA

Seminole Hard Rock Hotel & Casino Tampa Named Luckiest Casino in US by Casinos.com

Seminole Hard Rock Hotel & Casino Tampa has been named the luckiest casino in the US according to a recent study conducted by Casinos.com. The resort claimed the top spot based on an in-depth analysis of Tripadvisor reviews, measuring the frequency of luck-related keyword mentions.

With a 25.49% luck rate, Seminole Hard Rock Tampa topped the list thanks to glowing guest feedback, including frequent mentions of jackpots, hand pays and bonus wins. 50 reviews mentioned the word “jackpot,” and 19 even referenced a “hand pay.”

Casinos.com tracked keywords such as lucky, luck, won, winning, success, jackpot, hand pay, winner, bonus, profit to determine which U.S. casinos inspired the most winning moments among visitors.

“I hit 4 jackpots. I stayed one night. I had a blast. The machines are as loose as anywhere else,” wrote one Tripadvisor reviewer, noted Casinos.com, capturing the essence of why the casino landed in the No. 1 spot.

“We’ve always known this was a lucky casino, but it’s exciting to see that recognized through data-driven research. It’s a testament to the vibrant energy on our casino floor and the unforgettable experiences we strive to create for every guest,” said Steve Bonner, President of Seminole Hard Rock Hotel & Casino Tampa.

The ranking reinforces Seminole Hard Rock Tampa’s reputation as one of the premier gaming and entertainment destinations in the US. Seminole Hard Rock Tampa was not involved in the study and was unaware of it until the results were publicly released.

Over the past year, Seminole Hard Rock Tampa has paid out nearly 839,000 jackpots totaling more than $2.45 billion, continuing to deliver thrilling high-stakes gaming. Since May 1, 2024, the casino resort has awarded 375 jackpots of $100,000 or more, amounting to an impressive $61 million in winnings. Notably, 47 of those massive wins stemmed from bets of $5 or less and nine came from wagers of $3 or less.

Seminole Hard Rock Tampa offers a fully integrated casino experience with a sleek, modern design and welcoming atmosphere of 245,000 square feet of gaming space and entertainment. With 5230 of the hottest slot machines and a full range of table games such as poker, blackjack and baccarat, there is no shortage of opportunities to win. Additionally, guests can enjoy live craps, roulette, and sports betting at their leisure.

-

Canada5 days ago

Canada5 days agoAGCO Fines Great Canadian Casino Resort Toronto $350,000 for Serious Regulatory Violations Linked to Impromptu After-Party on Gaming Floor

-

Compliance Updates5 days ago

Compliance Updates5 days agoEsportes da Sorte holds forum on “Integrity in Sports” with Ceará and Náutico

-

Latest News5 days ago

Latest News5 days agoBlokotech unveils Cristian Tonanti as new Casino Partnership Manager

-

Latest News5 days ago

Latest News5 days agoEDGE Boost Named Preferred Payment Method for World Series of Poker Event Series

-

Latest News5 days ago

Latest News5 days agoFIRST and Genius Sports Extend Landmark Data Partnership, Powering Continued Growth

-

Canada5 days ago

Canada5 days agoIGT and Atlantic Lottery Sign Eight-Year Video Lottery Central System Technology Agreement

-

Latest News4 days ago

Latest News4 days agoNASCAR & iRacing Renew Partnership with PlayVS

-

Latest News3 days ago

Latest News3 days agoRivalry Reports Full-Year 2024 Results as Strategic Turnaround Takes Hold, Operating Loss Narrows, and Efficiency Improves