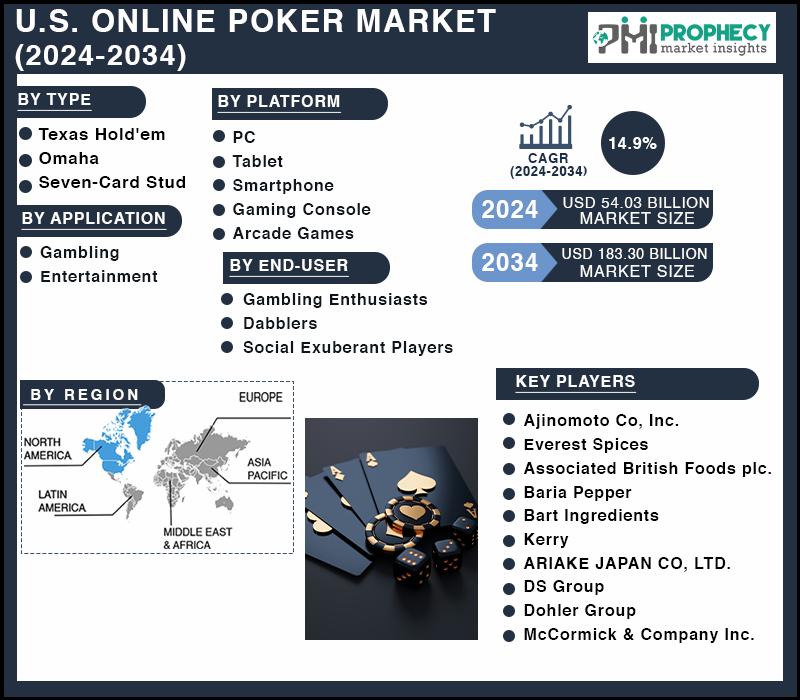

U.S. Online Poker (Gambling) Market Share Forecasted to Reach USD 183.30 Billion by 2034, at 14.9% CAGR: Prophecy Market Insights

| “U.S. Online Poker Market” from 2024-2034 with covered segments By Type (Texas Hold’em, Omaha, Seven-Card Stud, and Other Games), By Platform (PC, Tablet, Smartphone, Gaming Console, and Arcade Games), By Application (Gambling and Entertainment), By End-User (Gambling Enthusiasts, Dabblers, and Social Exuberant Players) Forecast, (2024-2034), which provides the perfect mix of market strategies, and industrial expertise with new cutting-edge technology to give the best experience. |

| Covina, Aug. 05, 2024 (GLOBE NEWSWIRE) — According to Prophecy Market Insights, the U.S. online poker market size and share is projected to grow from USD 54.03 Billion in 2024 and is forecasted to reach USD 183.30 Billion by 2034, exhibiting a compound annual growth rate (CAGR) of 14.9% during the forecast period (2024 – 2034).

U.S. Online Poker Market Report Overview In the game of online poker, a player gets to play against other opponents across the globe. This game requires one not only to choose among the several varieties of poker available, like Texas Hold’em, Omaha, and Seven-Card Stud, but also to log in to some websites that deal with online poker. Bets are made according to the strength of the hand with virtual chips. At the end of every round, the best hand collects the pot. Apart from anonymity, speed, convenience, and the number of tables, a player can play from anywhere with an internet connection, and many platforms allow a person to play at many different tables. The legal landscape of the U.S. online poker market has changed dramatically over the years. Big poker operators such as PokerStars and Full Tilt Poker used to be bigger players until legal complications and regulatory changes came hard on the industry after the events of Black Friday in 2011. The United States adopted state-by-state online gambling regulation, where certain states passed bills to legalize online poker and others were vehemently opposed. Today’s market is fragmented because only a few states allow regulated online poker. Other significant challenges include variations of the legislation among states, market fragmentation, pressure from new entrants and social gaming products, and fewer players. Still, potential growth might come out of the prospective legalization that is being considered by other states.

Our Free Sample Report includes:

Competitive Landscape: The U.S. online Poker Market is characterized by rapid growth, technological innovation, and fierce competition. Companies are expanding their global presence, focusing on sustainability, and diversifying their service offerings to stay competitive. Some of the Key Market Players:

Analyst View: In the U.S. market, operators like PokerStars and Full Tilt Poker used to be small entities, but since Black Friday in 2011, a fragmentation process began, with legislation very different from one country to another, added pressure from new entrants, and social gaming products pressing on the industry. Improved technology has increased the reach of online poker to younger demographics, especially those who love mobile gadgets with user-friendly applications and responsive websites. Demographic changes at a rapid pace, like urbanization and lifestyle changes, have also significantly shifted people’s interest in these online gambling activities. Trends affecting the U.S. online poker market include changing laws and regulations that have enabled operators to invest, innovate, and develop their businesses around uniformity and clarity. The promulgation of specific licensing rules, consumer protection, and dispute resolution procedures has resulted in a more respectable and trustworthy sector for players regarding the integrity and fairness of the games. Market Dynamics: Drivers: Involvement of Technology

Demographical changes

Market Trends: Changes in Law and Regulation

Segmentation: U.S. online Poker Market is segmented based on Type, Application, and Region. Type Insights

Application Insights

Recent Development:

Regional Insights

The North American online poker market is complex and dynamic; the United States itself is a nascent yet potential jackpot in its entirety. It is characterized by state-by-state regulation against the patchy backdrop of laws and the 2011 “Black Friday” crackdown. Barring all odds, online poker has been legalized by a few states, and it is slowly gaining its lost glory. Some of the important states representing the market are New Jersey, Nevada, Delaware, Michigan, and Pennsylvania. Such challenges include regulatory uncertainty, market fragmentation, and black markets. Another challenge to the operators and players is the inconsistent regulatory environment from state to state. A contributing factor to this market fragmentation is the lack of interstate poker agreements that hold back player pools, killing competition in its tracks. Illegal online poker sites remain in operation, tainting the legal marketplace. Browse Detail Report on “U.S. Online Poker Market Size, Share, By Type (Texas Hold’em, Omaha, Seven-Card Stud, and Other Games), By Platform (PC, Tablet, Smartphone, Gaming Console, and Arcade Games), By Application (Gambling and Entertainment), By End-User (Gambling Enthusiasts, Dabblers, and Social Exuberant Players) – Trends, Analysis, and Forecast till 2034” with complete TOC @ prophecymarketinsights.com/market_insight/u-s-online-poker-market-5338

|